Interest in practical financial education increases among teenage minors

입력 2024.11.17 (00:26)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

As students finish their college entrance exams and begin to relax, what activities can they engage in that would be meaningful?

Financial education, which is essential before becoming an adult and entering into credit transactions, seems to be a good choice.

Reporter Hwang Hyun-kyu will inform us about the type of education being provided.

[Report]

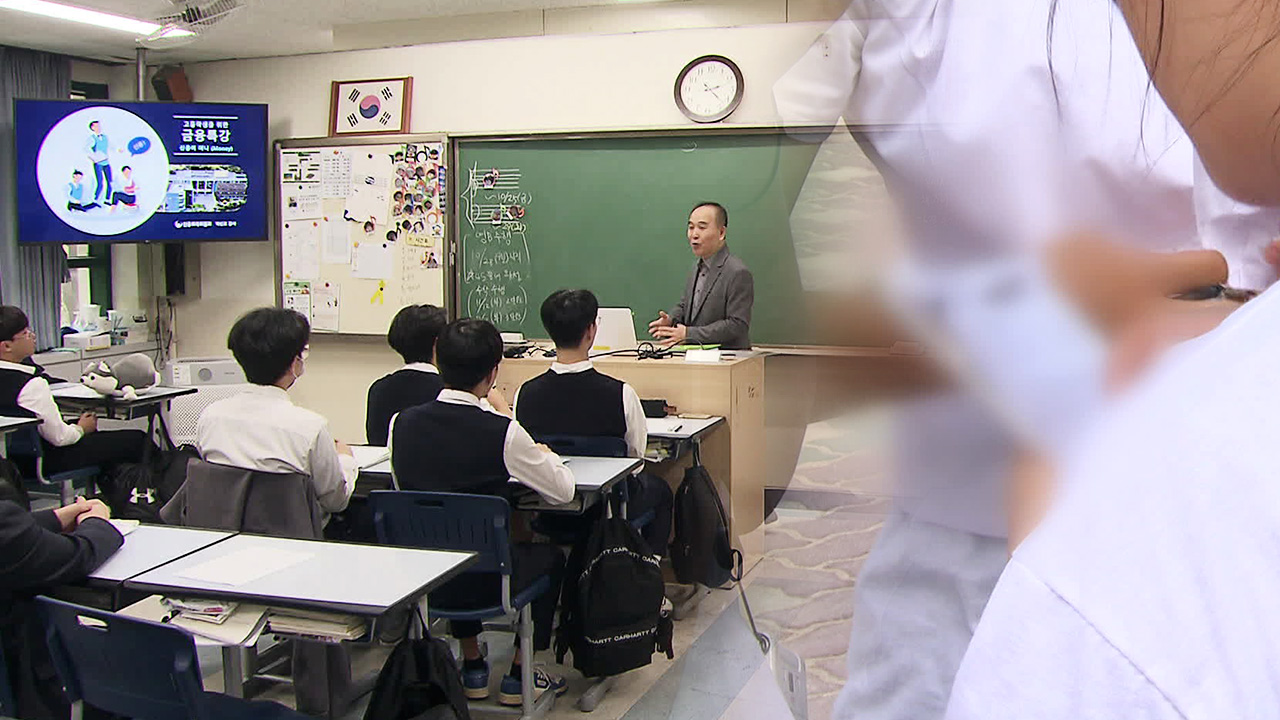

Twenty high school students are focused in this class.

They are being informed about borrowing money, such as student loans, as they prepare to become adults.

[Park Sun-ho/Expert Instructor at the Credit Recovery Commission: "Do you think you have a credit score or not? (We don't.)"]

["There isn't much time left. Society will start evaluating your creditworthiness."]

This year, the number of classes conducted by this institution for high school students in Seoul has increased to 93, a significant jump from just 3 last year.

This is due to the growing interest among teenagers in practical finance, such as investing and borrowing.

According to statistics from a securities firm, the number of minors holding stocks has increased 13 times over the past five years.

However, despite the increased interest, the basic knowledge of finance remains lacking.

[Park Sun-ho/Expert Instructor at the Credit Recovery Commission: "Do you think you will fall victim to financial scams, or not? (I don't think so.) Everyone thinks that way."]

More than one in three middle and high school students reported experiencing difficulties due to a lack of financial knowledge.

[Nam Jang-hyun/Second-year student at Doksan High School: "I think among my friends, there are only about two or three out of ten who invest in stocks. But most of them seem to be doing it without really knowing much."]

The percentage of high school students who have experienced financial damage, such as illegal loans, is 13%, which means about 1 in 7.

[Choi Hyun-ja/Professor of Consumer Studies at Seoul National University: "There are many who come across people making quick money, and they can easily get swept up in peer pressure, making them very vulnerable."]

Institutions where high school seniors can apply for financial classes include the Financial Supervisory Service's Financial Education Center, the Credit Recovery Commission, and the Seoul City government.

Although the lectures are free, prior reservation is necessary, and applications can be made by school groups.

This is Hwang Hyun-kyu from KBS News.

As students finish their college entrance exams and begin to relax, what activities can they engage in that would be meaningful?

Financial education, which is essential before becoming an adult and entering into credit transactions, seems to be a good choice.

Reporter Hwang Hyun-kyu will inform us about the type of education being provided.

[Report]

Twenty high school students are focused in this class.

They are being informed about borrowing money, such as student loans, as they prepare to become adults.

[Park Sun-ho/Expert Instructor at the Credit Recovery Commission: "Do you think you have a credit score or not? (We don't.)"]

["There isn't much time left. Society will start evaluating your creditworthiness."]

This year, the number of classes conducted by this institution for high school students in Seoul has increased to 93, a significant jump from just 3 last year.

This is due to the growing interest among teenagers in practical finance, such as investing and borrowing.

According to statistics from a securities firm, the number of minors holding stocks has increased 13 times over the past five years.

However, despite the increased interest, the basic knowledge of finance remains lacking.

[Park Sun-ho/Expert Instructor at the Credit Recovery Commission: "Do you think you will fall victim to financial scams, or not? (I don't think so.) Everyone thinks that way."]

More than one in three middle and high school students reported experiencing difficulties due to a lack of financial knowledge.

[Nam Jang-hyun/Second-year student at Doksan High School: "I think among my friends, there are only about two or three out of ten who invest in stocks. But most of them seem to be doing it without really knowing much."]

The percentage of high school students who have experienced financial damage, such as illegal loans, is 13%, which means about 1 in 7.

[Choi Hyun-ja/Professor of Consumer Studies at Seoul National University: "There are many who come across people making quick money, and they can easily get swept up in peer pressure, making them very vulnerable."]

Institutions where high school seniors can apply for financial classes include the Financial Supervisory Service's Financial Education Center, the Credit Recovery Commission, and the Seoul City government.

Although the lectures are free, prior reservation is necessary, and applications can be made by school groups.

This is Hwang Hyun-kyu from KBS News.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Interest in practical financial education increases among teenage minors

-

- 입력 2024-11-17 00:26:47

[Anchor]

As students finish their college entrance exams and begin to relax, what activities can they engage in that would be meaningful?

Financial education, which is essential before becoming an adult and entering into credit transactions, seems to be a good choice.

Reporter Hwang Hyun-kyu will inform us about the type of education being provided.

[Report]

Twenty high school students are focused in this class.

They are being informed about borrowing money, such as student loans, as they prepare to become adults.

[Park Sun-ho/Expert Instructor at the Credit Recovery Commission: "Do you think you have a credit score or not? (We don't.)"]

["There isn't much time left. Society will start evaluating your creditworthiness."]

This year, the number of classes conducted by this institution for high school students in Seoul has increased to 93, a significant jump from just 3 last year.

This is due to the growing interest among teenagers in practical finance, such as investing and borrowing.

According to statistics from a securities firm, the number of minors holding stocks has increased 13 times over the past five years.

However, despite the increased interest, the basic knowledge of finance remains lacking.

[Park Sun-ho/Expert Instructor at the Credit Recovery Commission: "Do you think you will fall victim to financial scams, or not? (I don't think so.) Everyone thinks that way."]

More than one in three middle and high school students reported experiencing difficulties due to a lack of financial knowledge.

[Nam Jang-hyun/Second-year student at Doksan High School: "I think among my friends, there are only about two or three out of ten who invest in stocks. But most of them seem to be doing it without really knowing much."]

The percentage of high school students who have experienced financial damage, such as illegal loans, is 13%, which means about 1 in 7.

[Choi Hyun-ja/Professor of Consumer Studies at Seoul National University: "There are many who come across people making quick money, and they can easily get swept up in peer pressure, making them very vulnerable."]

Institutions where high school seniors can apply for financial classes include the Financial Supervisory Service's Financial Education Center, the Credit Recovery Commission, and the Seoul City government.

Although the lectures are free, prior reservation is necessary, and applications can be made by school groups.

This is Hwang Hyun-kyu from KBS News.

As students finish their college entrance exams and begin to relax, what activities can they engage in that would be meaningful?

Financial education, which is essential before becoming an adult and entering into credit transactions, seems to be a good choice.

Reporter Hwang Hyun-kyu will inform us about the type of education being provided.

[Report]

Twenty high school students are focused in this class.

They are being informed about borrowing money, such as student loans, as they prepare to become adults.

[Park Sun-ho/Expert Instructor at the Credit Recovery Commission: "Do you think you have a credit score or not? (We don't.)"]

["There isn't much time left. Society will start evaluating your creditworthiness."]

This year, the number of classes conducted by this institution for high school students in Seoul has increased to 93, a significant jump from just 3 last year.

This is due to the growing interest among teenagers in practical finance, such as investing and borrowing.

According to statistics from a securities firm, the number of minors holding stocks has increased 13 times over the past five years.

However, despite the increased interest, the basic knowledge of finance remains lacking.

[Park Sun-ho/Expert Instructor at the Credit Recovery Commission: "Do you think you will fall victim to financial scams, or not? (I don't think so.) Everyone thinks that way."]

More than one in three middle and high school students reported experiencing difficulties due to a lack of financial knowledge.

[Nam Jang-hyun/Second-year student at Doksan High School: "I think among my friends, there are only about two or three out of ten who invest in stocks. But most of them seem to be doing it without really knowing much."]

The percentage of high school students who have experienced financial damage, such as illegal loans, is 13%, which means about 1 in 7.

[Choi Hyun-ja/Professor of Consumer Studies at Seoul National University: "There are many who come across people making quick money, and they can easily get swept up in peer pressure, making them very vulnerable."]

Institutions where high school seniors can apply for financial classes include the Financial Supervisory Service's Financial Education Center, the Credit Recovery Commission, and the Seoul City government.

Although the lectures are free, prior reservation is necessary, and applications can be made by school groups.

This is Hwang Hyun-kyu from KBS News.

-

-

황현규 기자 help@kbs.co.kr

황현규 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] “윤석열·김용현 등 공모해 군사상 이익 해쳐”<br>…외환죄 대신 일반이적죄 적용](/data/layer/904/2025/07/20250714_3VTJV3.jpg)

이 기사에 대한 의견을 남겨주세요.