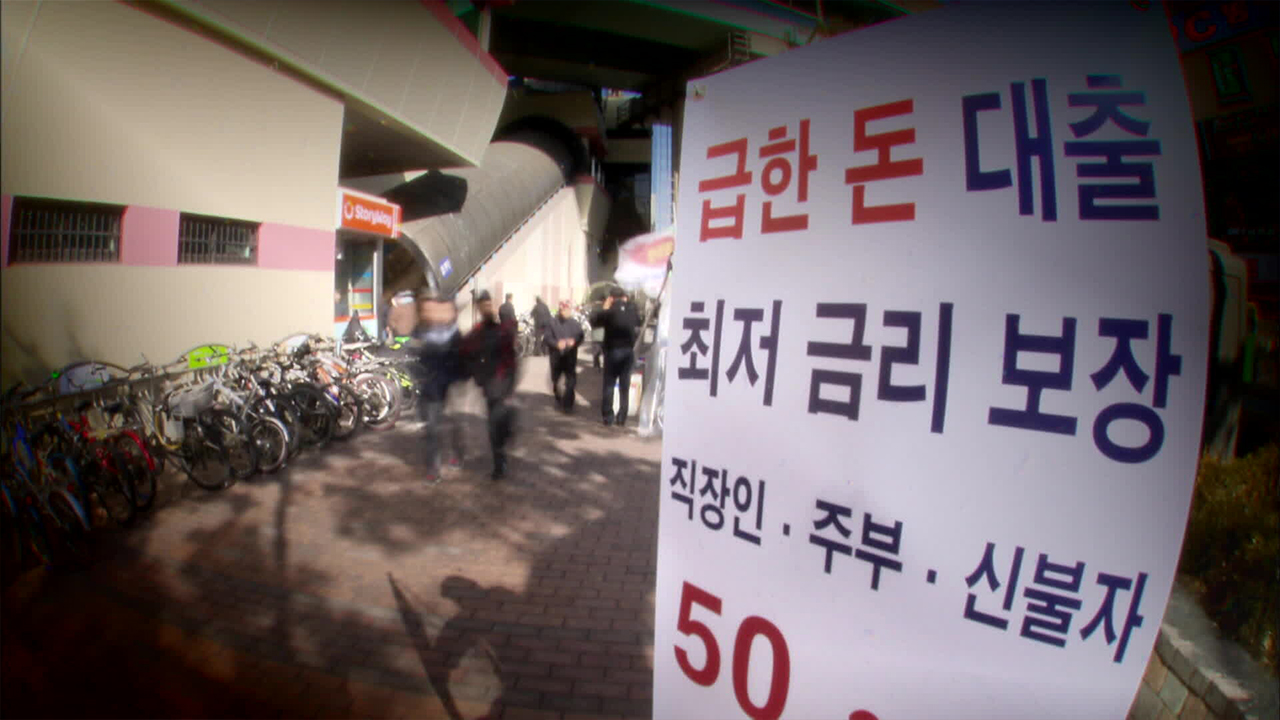

Rising illegal private financing highlights gaps in support for low-credit borrowers

입력 2024.11.22 (01:07)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

Yes, if debt collection is conducted in this manner, debtors will essentially be unable to engage in social activities, and acquaintances may be exposed to various other crimes.

The government has been making various efforts through multiple measures, but what strategies are needed to enhance their effectiveness?

Reporter Choi In-young has looked into it.

[Report]

A video of a military officer has been posted on a social media account.

There are dozens of other videos verifying private loans.

All of them contain information that loans were taken out using the personal information of acquaintances as collateral.

In her 20s, person C also received several text messages from illegal loan sharks.

[Person C/Victim of Personal Information Leak/Voice Altered: "If I can't repay the money by the payment date, the debtor said it was fine to sell or hand over this personal information."]

There were also threats to sue friends.

[Person C/Victim of Personal Information Leak/Voice Altered: "To be removed from the list, those whose information was leaked must file a complaint against their friend for violating the Information and Communications Network Act, then they'll delete it."]

When personal information is leaked like this, it can become a target for other crimes, such as reading room scams.

To reduce the harm of illegal private financing, the government has been responding by forming a government-wide task force since 2022.

Although special crackdowns have increased prosecutions and arrests, reports of damage are also on the rise.

Financial authorities have pledged to amend the Act on Registration of Credit Business and Protection of Finance Users to reduce the number of low-income individuals turning to illegal private financing, but there are concerns that it may instead push low-income and low-credit individuals further into hardship.

In fact, the loan approval rate at loan companies, which are the last resort for these individuals, is only in the 5% range.

Experts advise that raising the current legal maximum interest rate of 20% and revitalizing funding for the lending industry are realistic solutions.

[Choi Chul/Professor of Consumer Economics at Sookmyung Women's University: "While it is certainly necessary for the government to provide credit through policy finance, it is also essential for the private sector to function properly in this market (loan industry)."]

Last year, it is estimated that up to 91,000 low-credit individuals shifted from lending companies to illegal private financing.

This is KBS News, Choi In-young.

Yes, if debt collection is conducted in this manner, debtors will essentially be unable to engage in social activities, and acquaintances may be exposed to various other crimes.

The government has been making various efforts through multiple measures, but what strategies are needed to enhance their effectiveness?

Reporter Choi In-young has looked into it.

[Report]

A video of a military officer has been posted on a social media account.

There are dozens of other videos verifying private loans.

All of them contain information that loans were taken out using the personal information of acquaintances as collateral.

In her 20s, person C also received several text messages from illegal loan sharks.

[Person C/Victim of Personal Information Leak/Voice Altered: "If I can't repay the money by the payment date, the debtor said it was fine to sell or hand over this personal information."]

There were also threats to sue friends.

[Person C/Victim of Personal Information Leak/Voice Altered: "To be removed from the list, those whose information was leaked must file a complaint against their friend for violating the Information and Communications Network Act, then they'll delete it."]

When personal information is leaked like this, it can become a target for other crimes, such as reading room scams.

To reduce the harm of illegal private financing, the government has been responding by forming a government-wide task force since 2022.

Although special crackdowns have increased prosecutions and arrests, reports of damage are also on the rise.

Financial authorities have pledged to amend the Act on Registration of Credit Business and Protection of Finance Users to reduce the number of low-income individuals turning to illegal private financing, but there are concerns that it may instead push low-income and low-credit individuals further into hardship.

In fact, the loan approval rate at loan companies, which are the last resort for these individuals, is only in the 5% range.

Experts advise that raising the current legal maximum interest rate of 20% and revitalizing funding for the lending industry are realistic solutions.

[Choi Chul/Professor of Consumer Economics at Sookmyung Women's University: "While it is certainly necessary for the government to provide credit through policy finance, it is also essential for the private sector to function properly in this market (loan industry)."]

Last year, it is estimated that up to 91,000 low-credit individuals shifted from lending companies to illegal private financing.

This is KBS News, Choi In-young.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Rising illegal private financing highlights gaps in support for low-credit borrowers

-

- 입력 2024-11-22 01:07:04

[Anchor]

Yes, if debt collection is conducted in this manner, debtors will essentially be unable to engage in social activities, and acquaintances may be exposed to various other crimes.

The government has been making various efforts through multiple measures, but what strategies are needed to enhance their effectiveness?

Reporter Choi In-young has looked into it.

[Report]

A video of a military officer has been posted on a social media account.

There are dozens of other videos verifying private loans.

All of them contain information that loans were taken out using the personal information of acquaintances as collateral.

In her 20s, person C also received several text messages from illegal loan sharks.

[Person C/Victim of Personal Information Leak/Voice Altered: "If I can't repay the money by the payment date, the debtor said it was fine to sell or hand over this personal information."]

There were also threats to sue friends.

[Person C/Victim of Personal Information Leak/Voice Altered: "To be removed from the list, those whose information was leaked must file a complaint against their friend for violating the Information and Communications Network Act, then they'll delete it."]

When personal information is leaked like this, it can become a target for other crimes, such as reading room scams.

To reduce the harm of illegal private financing, the government has been responding by forming a government-wide task force since 2022.

Although special crackdowns have increased prosecutions and arrests, reports of damage are also on the rise.

Financial authorities have pledged to amend the Act on Registration of Credit Business and Protection of Finance Users to reduce the number of low-income individuals turning to illegal private financing, but there are concerns that it may instead push low-income and low-credit individuals further into hardship.

In fact, the loan approval rate at loan companies, which are the last resort for these individuals, is only in the 5% range.

Experts advise that raising the current legal maximum interest rate of 20% and revitalizing funding for the lending industry are realistic solutions.

[Choi Chul/Professor of Consumer Economics at Sookmyung Women's University: "While it is certainly necessary for the government to provide credit through policy finance, it is also essential for the private sector to function properly in this market (loan industry)."]

Last year, it is estimated that up to 91,000 low-credit individuals shifted from lending companies to illegal private financing.

This is KBS News, Choi In-young.

Yes, if debt collection is conducted in this manner, debtors will essentially be unable to engage in social activities, and acquaintances may be exposed to various other crimes.

The government has been making various efforts through multiple measures, but what strategies are needed to enhance their effectiveness?

Reporter Choi In-young has looked into it.

[Report]

A video of a military officer has been posted on a social media account.

There are dozens of other videos verifying private loans.

All of them contain information that loans were taken out using the personal information of acquaintances as collateral.

In her 20s, person C also received several text messages from illegal loan sharks.

[Person C/Victim of Personal Information Leak/Voice Altered: "If I can't repay the money by the payment date, the debtor said it was fine to sell or hand over this personal information."]

There were also threats to sue friends.

[Person C/Victim of Personal Information Leak/Voice Altered: "To be removed from the list, those whose information was leaked must file a complaint against their friend for violating the Information and Communications Network Act, then they'll delete it."]

When personal information is leaked like this, it can become a target for other crimes, such as reading room scams.

To reduce the harm of illegal private financing, the government has been responding by forming a government-wide task force since 2022.

Although special crackdowns have increased prosecutions and arrests, reports of damage are also on the rise.

Financial authorities have pledged to amend the Act on Registration of Credit Business and Protection of Finance Users to reduce the number of low-income individuals turning to illegal private financing, but there are concerns that it may instead push low-income and low-credit individuals further into hardship.

In fact, the loan approval rate at loan companies, which are the last resort for these individuals, is only in the 5% range.

Experts advise that raising the current legal maximum interest rate of 20% and revitalizing funding for the lending industry are realistic solutions.

[Choi Chul/Professor of Consumer Economics at Sookmyung Women's University: "While it is certainly necessary for the government to provide credit through policy finance, it is also essential for the private sector to function properly in this market (loan industry)."]

Last year, it is estimated that up to 91,000 low-credit individuals shifted from lending companies to illegal private financing.

This is KBS News, Choi In-young.

-

-

최인영 기자 inyoung@kbs.co.kr

최인영 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.