S. Korea's chips industry faces challenges ahead

입력 2025.01.02 (00:08)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

Last year, although the overall economy struggled, exports reached a record high and were a positive highlight.

However, there are many predictions that exports this year will face instability.

First, let's take a look at our key item, the semiconductor industry, with reporter Gye Hyun-woo.

[Report]

A man is solving a math problem with the help of OpenAI's ChatGPT.

["This is the result. (It looks perfect.)"]

The artificial intelligence accelerators used in the servers of ChatGPT contain high-performance, high-bandwidth memory.

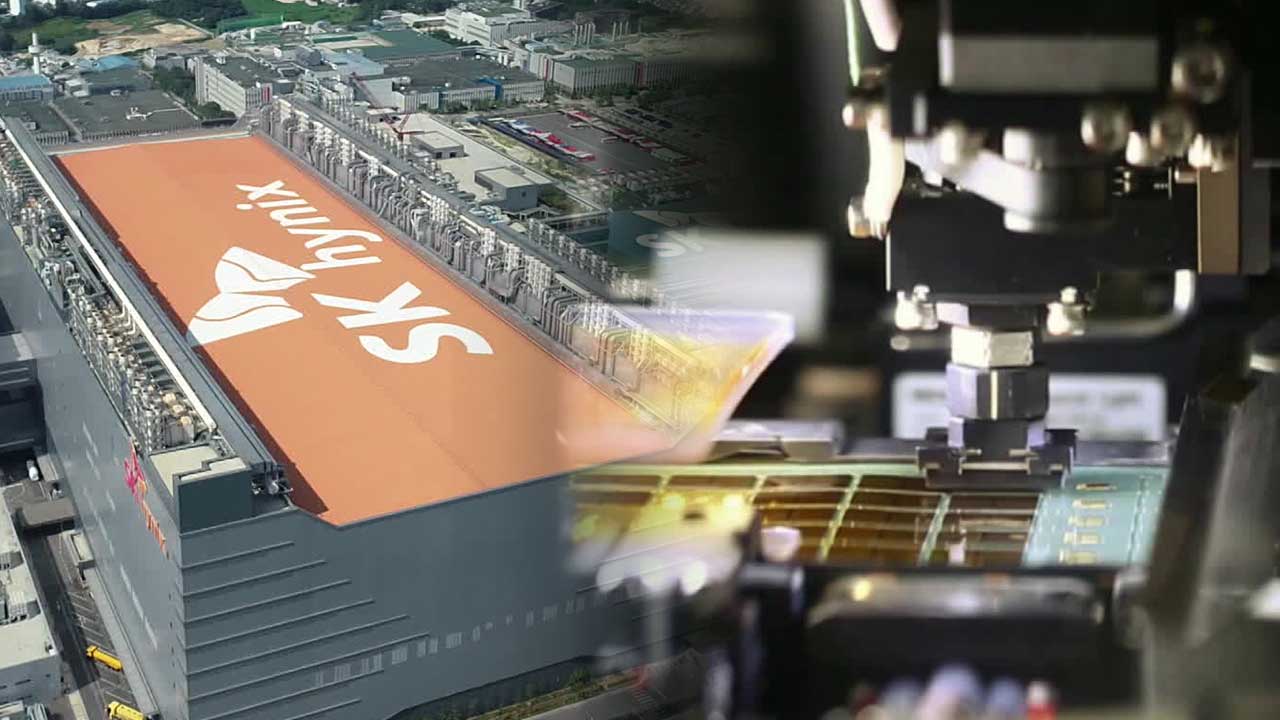

With the AI boom, the demand for high-bandwidth memory has significantly increased, and SK Hynix has successfully taken the lead in this field by responding proactively.

By predicting and responding to demand in advance, they achieved the highest operating profit ever in the third quarter of last year.

[Chey Tae-won/SK Group Chairman/Nov. 2025: "(For 6th generation high-bandwidth memory), there was a planned supply schedule, but NVIDIA requested us to move it forward, so we worked to advance it by six months."]

On the other hand, the traditional mainstay, general-purpose DRAM, is struggling.

Korea produces 75% of the world's DRAM semiconductors.

However, due to weak demand for IT devices and fierce competition from China, expectations for the semiconductor market this year have halved compared to last year.

[Kim Dong-won/Head of KB Securities Research Center: "China's Changxin Memory is expected to increase its DRAM market share to 15% next year through aggressive low-price sales, so domestic semiconductor companies need to pursue a high-value AI memory expansion strategy."]

South Korea still faces challenges in its weaker areas, such as system semiconductors and foundries, or semiconductor contract manufacturing.

In the foundry sector, Samsung Electronics is making aggressive investments, including its Pyeongtaek production base and a factory in Texas, USA, but its market share is still about seven times smaller than that of the world's number one, Taiwan's TSMC.

The design sector, which currently accounts for only 3% of the market share, also requires significant development this year.

[Park Sung-hyun/CEO of AI semiconductor startup Rebellions: "Fabless (design-focused) companies have not yet made a significant impact. Our big goal is to create a design company like NVIDIA."]

As countries raise protectionist barriers regarding semiconductors, the industry is calling for government-level support.

This is KBS News, Gye Hyun-woo.

Last year, although the overall economy struggled, exports reached a record high and were a positive highlight.

However, there are many predictions that exports this year will face instability.

First, let's take a look at our key item, the semiconductor industry, with reporter Gye Hyun-woo.

[Report]

A man is solving a math problem with the help of OpenAI's ChatGPT.

["This is the result. (It looks perfect.)"]

The artificial intelligence accelerators used in the servers of ChatGPT contain high-performance, high-bandwidth memory.

With the AI boom, the demand for high-bandwidth memory has significantly increased, and SK Hynix has successfully taken the lead in this field by responding proactively.

By predicting and responding to demand in advance, they achieved the highest operating profit ever in the third quarter of last year.

[Chey Tae-won/SK Group Chairman/Nov. 2025: "(For 6th generation high-bandwidth memory), there was a planned supply schedule, but NVIDIA requested us to move it forward, so we worked to advance it by six months."]

On the other hand, the traditional mainstay, general-purpose DRAM, is struggling.

Korea produces 75% of the world's DRAM semiconductors.

However, due to weak demand for IT devices and fierce competition from China, expectations for the semiconductor market this year have halved compared to last year.

[Kim Dong-won/Head of KB Securities Research Center: "China's Changxin Memory is expected to increase its DRAM market share to 15% next year through aggressive low-price sales, so domestic semiconductor companies need to pursue a high-value AI memory expansion strategy."]

South Korea still faces challenges in its weaker areas, such as system semiconductors and foundries, or semiconductor contract manufacturing.

In the foundry sector, Samsung Electronics is making aggressive investments, including its Pyeongtaek production base and a factory in Texas, USA, but its market share is still about seven times smaller than that of the world's number one, Taiwan's TSMC.

The design sector, which currently accounts for only 3% of the market share, also requires significant development this year.

[Park Sung-hyun/CEO of AI semiconductor startup Rebellions: "Fabless (design-focused) companies have not yet made a significant impact. Our big goal is to create a design company like NVIDIA."]

As countries raise protectionist barriers regarding semiconductors, the industry is calling for government-level support.

This is KBS News, Gye Hyun-woo.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- S. Korea's chips industry faces challenges ahead

-

- 입력 2025-01-02 00:08:03

[Anchor]

Last year, although the overall economy struggled, exports reached a record high and were a positive highlight.

However, there are many predictions that exports this year will face instability.

First, let's take a look at our key item, the semiconductor industry, with reporter Gye Hyun-woo.

[Report]

A man is solving a math problem with the help of OpenAI's ChatGPT.

["This is the result. (It looks perfect.)"]

The artificial intelligence accelerators used in the servers of ChatGPT contain high-performance, high-bandwidth memory.

With the AI boom, the demand for high-bandwidth memory has significantly increased, and SK Hynix has successfully taken the lead in this field by responding proactively.

By predicting and responding to demand in advance, they achieved the highest operating profit ever in the third quarter of last year.

[Chey Tae-won/SK Group Chairman/Nov. 2025: "(For 6th generation high-bandwidth memory), there was a planned supply schedule, but NVIDIA requested us to move it forward, so we worked to advance it by six months."]

On the other hand, the traditional mainstay, general-purpose DRAM, is struggling.

Korea produces 75% of the world's DRAM semiconductors.

However, due to weak demand for IT devices and fierce competition from China, expectations for the semiconductor market this year have halved compared to last year.

[Kim Dong-won/Head of KB Securities Research Center: "China's Changxin Memory is expected to increase its DRAM market share to 15% next year through aggressive low-price sales, so domestic semiconductor companies need to pursue a high-value AI memory expansion strategy."]

South Korea still faces challenges in its weaker areas, such as system semiconductors and foundries, or semiconductor contract manufacturing.

In the foundry sector, Samsung Electronics is making aggressive investments, including its Pyeongtaek production base and a factory in Texas, USA, but its market share is still about seven times smaller than that of the world's number one, Taiwan's TSMC.

The design sector, which currently accounts for only 3% of the market share, also requires significant development this year.

[Park Sung-hyun/CEO of AI semiconductor startup Rebellions: "Fabless (design-focused) companies have not yet made a significant impact. Our big goal is to create a design company like NVIDIA."]

As countries raise protectionist barriers regarding semiconductors, the industry is calling for government-level support.

This is KBS News, Gye Hyun-woo.

Last year, although the overall economy struggled, exports reached a record high and were a positive highlight.

However, there are many predictions that exports this year will face instability.

First, let's take a look at our key item, the semiconductor industry, with reporter Gye Hyun-woo.

[Report]

A man is solving a math problem with the help of OpenAI's ChatGPT.

["This is the result. (It looks perfect.)"]

The artificial intelligence accelerators used in the servers of ChatGPT contain high-performance, high-bandwidth memory.

With the AI boom, the demand for high-bandwidth memory has significantly increased, and SK Hynix has successfully taken the lead in this field by responding proactively.

By predicting and responding to demand in advance, they achieved the highest operating profit ever in the third quarter of last year.

[Chey Tae-won/SK Group Chairman/Nov. 2025: "(For 6th generation high-bandwidth memory), there was a planned supply schedule, but NVIDIA requested us to move it forward, so we worked to advance it by six months."]

On the other hand, the traditional mainstay, general-purpose DRAM, is struggling.

Korea produces 75% of the world's DRAM semiconductors.

However, due to weak demand for IT devices and fierce competition from China, expectations for the semiconductor market this year have halved compared to last year.

[Kim Dong-won/Head of KB Securities Research Center: "China's Changxin Memory is expected to increase its DRAM market share to 15% next year through aggressive low-price sales, so domestic semiconductor companies need to pursue a high-value AI memory expansion strategy."]

South Korea still faces challenges in its weaker areas, such as system semiconductors and foundries, or semiconductor contract manufacturing.

In the foundry sector, Samsung Electronics is making aggressive investments, including its Pyeongtaek production base and a factory in Texas, USA, but its market share is still about seven times smaller than that of the world's number one, Taiwan's TSMC.

The design sector, which currently accounts for only 3% of the market share, also requires significant development this year.

[Park Sung-hyun/CEO of AI semiconductor startup Rebellions: "Fabless (design-focused) companies have not yet made a significant impact. Our big goal is to create a design company like NVIDIA."]

As countries raise protectionist barriers regarding semiconductors, the industry is calling for government-level support.

This is KBS News, Gye Hyun-woo.

-

-

계현우 기자 kye@kbs.co.kr

계현우 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.