[Anchor]

This is commonly referred to as the 'red sticker.'

If debts are not repaid for a long time, a seizure that ties up assets occurs. To prevent this, there is the 'prohibition of seizure account.'

The intention is to make way for individuals to maintain their livelihoods through work while repaying their debts.

Reporter Choi In-young has the details.

[Report]

This is a woman in her 60s who has been undergoing debt adjustment for five years.

The 15 million won she borrowed over 20 years ago has ballooned to 60 million won.

[Ms. A/Debtor: "I used to work a long time ago, but I couldn't repay my debt from using credit cards and such. I thought I had paid everything off."]

She tried to find a job to make repayments little by little, but soon hit a wall.

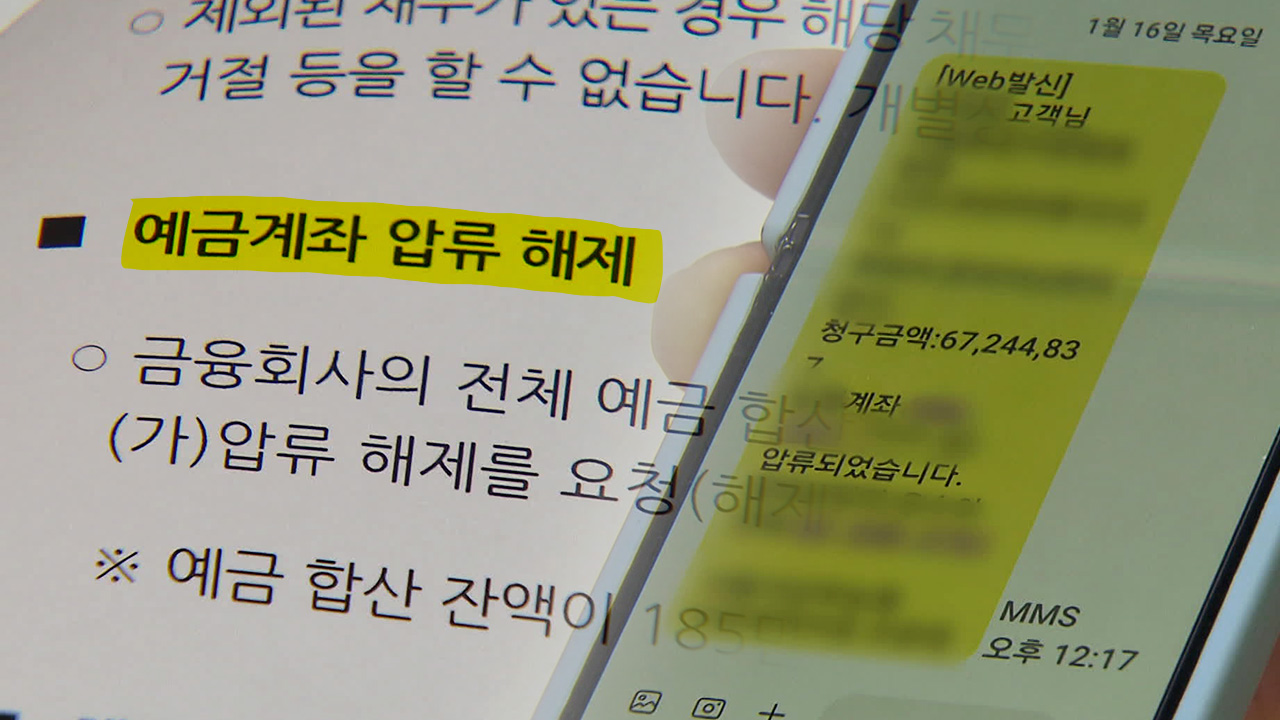

This is because all her accounts were seized, and her salary account disappeared.

[60s Debtor: "After working for three months, I felt really good. But after hearing the news of the seizure, I thought, should I quit my job again?"]

Under current law, no matter how much debt one has, 1.85 million won for living expenses cannot be seized.

However, the reality is different.

For example, if a debtor has 5 million won in their account,

1.85 million won should be exempt from the seizure and only seize the excess,

but this is just theoretical.

In practice, the entire account is seized, and the full amount is tied up.

This blocks the path to finding a job, saving money, and gradually repaying debts.

[50s Debtor: "You need to create an environment where people can work so that money can come into the account, allowing for repayment and living, and that cycle needs to happen."]

There is a way to apply to the court to partially lift the seizure, but both the process and costs are significant barriers.

About 100,000 people who are more than three months overdue are subject to seizure each year, but only about 2 out of 10 apply for release.

[Jan. 8th/ National Assembly: "I declare that the amendment has been passed."]

The 'Prohibition of Seizure of Living Expense Accounts' law was passed with bipartisan agreement on the 8th.

The key points are one account per individual and prohibition of seizure at the source.

It will be implemented early next year, considering the time needed for financial institutions to prepare.

It is undecided which of the multiple accounts will be exempt from seizure, but it is likely that the debtor will be allowed to choose.

This is KBS News, Choi In-young.

This is commonly referred to as the 'red sticker.'

If debts are not repaid for a long time, a seizure that ties up assets occurs. To prevent this, there is the 'prohibition of seizure account.'

The intention is to make way for individuals to maintain their livelihoods through work while repaying their debts.

Reporter Choi In-young has the details.

[Report]

This is a woman in her 60s who has been undergoing debt adjustment for five years.

The 15 million won she borrowed over 20 years ago has ballooned to 60 million won.

[Ms. A/Debtor: "I used to work a long time ago, but I couldn't repay my debt from using credit cards and such. I thought I had paid everything off."]

She tried to find a job to make repayments little by little, but soon hit a wall.

This is because all her accounts were seized, and her salary account disappeared.

[60s Debtor: "After working for three months, I felt really good. But after hearing the news of the seizure, I thought, should I quit my job again?"]

Under current law, no matter how much debt one has, 1.85 million won for living expenses cannot be seized.

However, the reality is different.

For example, if a debtor has 5 million won in their account,

1.85 million won should be exempt from the seizure and only seize the excess,

but this is just theoretical.

In practice, the entire account is seized, and the full amount is tied up.

This blocks the path to finding a job, saving money, and gradually repaying debts.

[50s Debtor: "You need to create an environment where people can work so that money can come into the account, allowing for repayment and living, and that cycle needs to happen."]

There is a way to apply to the court to partially lift the seizure, but both the process and costs are significant barriers.

About 100,000 people who are more than three months overdue are subject to seizure each year, but only about 2 out of 10 apply for release.

[Jan. 8th/ National Assembly: "I declare that the amendment has been passed."]

The 'Prohibition of Seizure of Living Expense Accounts' law was passed with bipartisan agreement on the 8th.

The key points are one account per individual and prohibition of seizure at the source.

It will be implemented early next year, considering the time needed for financial institutions to prepare.

It is undecided which of the multiple accounts will be exempt from seizure, but it is likely that the debtor will be allowed to choose.

This is KBS News, Choi In-young.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Prohibition of seizure account

-

- 입력 2025-01-19 01:14:39

[Anchor]

This is commonly referred to as the 'red sticker.'

If debts are not repaid for a long time, a seizure that ties up assets occurs. To prevent this, there is the 'prohibition of seizure account.'

The intention is to make way for individuals to maintain their livelihoods through work while repaying their debts.

Reporter Choi In-young has the details.

[Report]

This is a woman in her 60s who has been undergoing debt adjustment for five years.

The 15 million won she borrowed over 20 years ago has ballooned to 60 million won.

[Ms. A/Debtor: "I used to work a long time ago, but I couldn't repay my debt from using credit cards and such. I thought I had paid everything off."]

She tried to find a job to make repayments little by little, but soon hit a wall.

This is because all her accounts were seized, and her salary account disappeared.

[60s Debtor: "After working for three months, I felt really good. But after hearing the news of the seizure, I thought, should I quit my job again?"]

Under current law, no matter how much debt one has, 1.85 million won for living expenses cannot be seized.

However, the reality is different.

For example, if a debtor has 5 million won in their account,

1.85 million won should be exempt from the seizure and only seize the excess,

but this is just theoretical.

In practice, the entire account is seized, and the full amount is tied up.

This blocks the path to finding a job, saving money, and gradually repaying debts.

[50s Debtor: "You need to create an environment where people can work so that money can come into the account, allowing for repayment and living, and that cycle needs to happen."]

There is a way to apply to the court to partially lift the seizure, but both the process and costs are significant barriers.

About 100,000 people who are more than three months overdue are subject to seizure each year, but only about 2 out of 10 apply for release.

[Jan. 8th/ National Assembly: "I declare that the amendment has been passed."]

The 'Prohibition of Seizure of Living Expense Accounts' law was passed with bipartisan agreement on the 8th.

The key points are one account per individual and prohibition of seizure at the source.

It will be implemented early next year, considering the time needed for financial institutions to prepare.

It is undecided which of the multiple accounts will be exempt from seizure, but it is likely that the debtor will be allowed to choose.

This is KBS News, Choi In-young.

This is commonly referred to as the 'red sticker.'

If debts are not repaid for a long time, a seizure that ties up assets occurs. To prevent this, there is the 'prohibition of seizure account.'

The intention is to make way for individuals to maintain their livelihoods through work while repaying their debts.

Reporter Choi In-young has the details.

[Report]

This is a woman in her 60s who has been undergoing debt adjustment for five years.

The 15 million won she borrowed over 20 years ago has ballooned to 60 million won.

[Ms. A/Debtor: "I used to work a long time ago, but I couldn't repay my debt from using credit cards and such. I thought I had paid everything off."]

She tried to find a job to make repayments little by little, but soon hit a wall.

This is because all her accounts were seized, and her salary account disappeared.

[60s Debtor: "After working for three months, I felt really good. But after hearing the news of the seizure, I thought, should I quit my job again?"]

Under current law, no matter how much debt one has, 1.85 million won for living expenses cannot be seized.

However, the reality is different.

For example, if a debtor has 5 million won in their account,

1.85 million won should be exempt from the seizure and only seize the excess,

but this is just theoretical.

In practice, the entire account is seized, and the full amount is tied up.

This blocks the path to finding a job, saving money, and gradually repaying debts.

[50s Debtor: "You need to create an environment where people can work so that money can come into the account, allowing for repayment and living, and that cycle needs to happen."]

There is a way to apply to the court to partially lift the seizure, but both the process and costs are significant barriers.

About 100,000 people who are more than three months overdue are subject to seizure each year, but only about 2 out of 10 apply for release.

[Jan. 8th/ National Assembly: "I declare that the amendment has been passed."]

The 'Prohibition of Seizure of Living Expense Accounts' law was passed with bipartisan agreement on the 8th.

The key points are one account per individual and prohibition of seizure at the source.

It will be implemented early next year, considering the time needed for financial institutions to prepare.

It is undecided which of the multiple accounts will be exempt from seizure, but it is likely that the debtor will be allowed to choose.

This is KBS News, Choi In-young.

-

-

최인영 기자 inyoung@kbs.co.kr

최인영 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[속보] 경찰 “서부지법 난입 등 이틀간 86명 연행…전담수사팀 편성”](/data/layer/904/2025/01/20250119_1JJCJs.jpg)

이 기사에 대한 의견을 남겨주세요.