[Anchor]

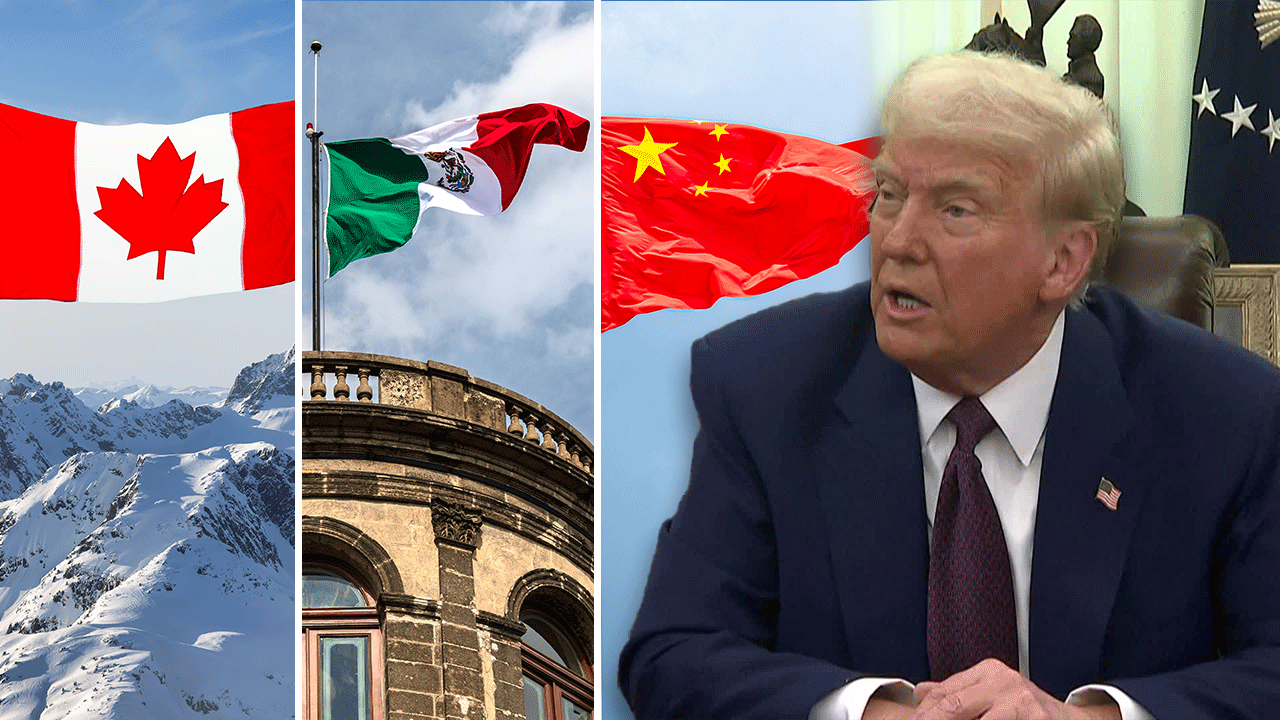

U.S. President Trump has begun imposing a 25% tariff on Canada and Mexico, which he had previously delayed for a month as a gesture of goodwill.

The long-standing free trade agreement and alliance among the three countries have proven ineffective.

In addition to the previously imposed 10% tariff on China, another 10% has now been added.

These three countries are the top three import sources for the U.S., collectively accounting for over 40% of total imports.

The tariff bomb from Trump is set to continue.

On the 2nd of next month, mutual tariffs and agricultural tariffs targeting the entire world are expected to be announced.

Countries burdened with these tariffs are vowing to retaliate, escalating the trade war.

This is Park Il-jung reporting from New York.

[Report]

Canada, Mexico, and China have immediately announced or hinted at retaliatory measures.

Canada has targeted U.S. orange juice, whiskey, and coffee products, while China has focused on U.S. chicken and wheat and other agricultural products.

Ultimately, the feared trade war has begun.

[Melanie Joly/Canadian Foreign Minister: "We are ready with 155 billion dollars worth of tariffs and we're ready with the first tranche of tariffs which is 30 billion which is already known."]

U.S. companies, already facing rising supplier costs and product price increases due to the existing 10% tariff on China, are now facing additional challenges.

[Joe Louis Shami/Children's Product Manufacturer: "Certain parts do come from Canada as well as Asia and Mexico sometimes. And if those are tariffed, so that will raise the price of the mattress."]

Moreover, it is uncertain how long the upcoming tariffs will last and to what extent they will be imposed.

Increased uncertainty has led to a sharp decline in risk assets like stocks and Bitcoin, while the value of safe assets like U.S. Treasury bonds has risen as a result.

[Chris Brigati/SWBC Chief Investment Officer: "I think the tariff scenario is definitively an inflationary. Right now, what I'm seeing and hearing is a little bit of a stagflation concern."]

If the U.S. economy struggles, the economies of other countries will face even greater difficulties.

While the U.S. is forcing each country to find its own way, the international trade relationships are too intricately intertwined for that to be easy.

This is Park Il-jung from KBS News in New York.

U.S. President Trump has begun imposing a 25% tariff on Canada and Mexico, which he had previously delayed for a month as a gesture of goodwill.

The long-standing free trade agreement and alliance among the three countries have proven ineffective.

In addition to the previously imposed 10% tariff on China, another 10% has now been added.

These three countries are the top three import sources for the U.S., collectively accounting for over 40% of total imports.

The tariff bomb from Trump is set to continue.

On the 2nd of next month, mutual tariffs and agricultural tariffs targeting the entire world are expected to be announced.

Countries burdened with these tariffs are vowing to retaliate, escalating the trade war.

This is Park Il-jung reporting from New York.

[Report]

Canada, Mexico, and China have immediately announced or hinted at retaliatory measures.

Canada has targeted U.S. orange juice, whiskey, and coffee products, while China has focused on U.S. chicken and wheat and other agricultural products.

Ultimately, the feared trade war has begun.

[Melanie Joly/Canadian Foreign Minister: "We are ready with 155 billion dollars worth of tariffs and we're ready with the first tranche of tariffs which is 30 billion which is already known."]

U.S. companies, already facing rising supplier costs and product price increases due to the existing 10% tariff on China, are now facing additional challenges.

[Joe Louis Shami/Children's Product Manufacturer: "Certain parts do come from Canada as well as Asia and Mexico sometimes. And if those are tariffed, so that will raise the price of the mattress."]

Moreover, it is uncertain how long the upcoming tariffs will last and to what extent they will be imposed.

Increased uncertainty has led to a sharp decline in risk assets like stocks and Bitcoin, while the value of safe assets like U.S. Treasury bonds has risen as a result.

[Chris Brigati/SWBC Chief Investment Officer: "I think the tariff scenario is definitively an inflationary. Right now, what I'm seeing and hearing is a little bit of a stagflation concern."]

If the U.S. economy struggles, the economies of other countries will face even greater difficulties.

While the U.S. is forcing each country to find its own way, the international trade relationships are too intricately intertwined for that to be easy.

This is Park Il-jung from KBS News in New York.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Trade war intensifies

-

- 입력 2025-03-04 23:52:23

[Anchor]

U.S. President Trump has begun imposing a 25% tariff on Canada and Mexico, which he had previously delayed for a month as a gesture of goodwill.

The long-standing free trade agreement and alliance among the three countries have proven ineffective.

In addition to the previously imposed 10% tariff on China, another 10% has now been added.

These three countries are the top three import sources for the U.S., collectively accounting for over 40% of total imports.

The tariff bomb from Trump is set to continue.

On the 2nd of next month, mutual tariffs and agricultural tariffs targeting the entire world are expected to be announced.

Countries burdened with these tariffs are vowing to retaliate, escalating the trade war.

This is Park Il-jung reporting from New York.

[Report]

Canada, Mexico, and China have immediately announced or hinted at retaliatory measures.

Canada has targeted U.S. orange juice, whiskey, and coffee products, while China has focused on U.S. chicken and wheat and other agricultural products.

Ultimately, the feared trade war has begun.

[Melanie Joly/Canadian Foreign Minister: "We are ready with 155 billion dollars worth of tariffs and we're ready with the first tranche of tariffs which is 30 billion which is already known."]

U.S. companies, already facing rising supplier costs and product price increases due to the existing 10% tariff on China, are now facing additional challenges.

[Joe Louis Shami/Children's Product Manufacturer: "Certain parts do come from Canada as well as Asia and Mexico sometimes. And if those are tariffed, so that will raise the price of the mattress."]

Moreover, it is uncertain how long the upcoming tariffs will last and to what extent they will be imposed.

Increased uncertainty has led to a sharp decline in risk assets like stocks and Bitcoin, while the value of safe assets like U.S. Treasury bonds has risen as a result.

[Chris Brigati/SWBC Chief Investment Officer: "I think the tariff scenario is definitively an inflationary. Right now, what I'm seeing and hearing is a little bit of a stagflation concern."]

If the U.S. economy struggles, the economies of other countries will face even greater difficulties.

While the U.S. is forcing each country to find its own way, the international trade relationships are too intricately intertwined for that to be easy.

This is Park Il-jung from KBS News in New York.

U.S. President Trump has begun imposing a 25% tariff on Canada and Mexico, which he had previously delayed for a month as a gesture of goodwill.

The long-standing free trade agreement and alliance among the three countries have proven ineffective.

In addition to the previously imposed 10% tariff on China, another 10% has now been added.

These three countries are the top three import sources for the U.S., collectively accounting for over 40% of total imports.

The tariff bomb from Trump is set to continue.

On the 2nd of next month, mutual tariffs and agricultural tariffs targeting the entire world are expected to be announced.

Countries burdened with these tariffs are vowing to retaliate, escalating the trade war.

This is Park Il-jung reporting from New York.

[Report]

Canada, Mexico, and China have immediately announced or hinted at retaliatory measures.

Canada has targeted U.S. orange juice, whiskey, and coffee products, while China has focused on U.S. chicken and wheat and other agricultural products.

Ultimately, the feared trade war has begun.

[Melanie Joly/Canadian Foreign Minister: "We are ready with 155 billion dollars worth of tariffs and we're ready with the first tranche of tariffs which is 30 billion which is already known."]

U.S. companies, already facing rising supplier costs and product price increases due to the existing 10% tariff on China, are now facing additional challenges.

[Joe Louis Shami/Children's Product Manufacturer: "Certain parts do come from Canada as well as Asia and Mexico sometimes. And if those are tariffed, so that will raise the price of the mattress."]

Moreover, it is uncertain how long the upcoming tariffs will last and to what extent they will be imposed.

Increased uncertainty has led to a sharp decline in risk assets like stocks and Bitcoin, while the value of safe assets like U.S. Treasury bonds has risen as a result.

[Chris Brigati/SWBC Chief Investment Officer: "I think the tariff scenario is definitively an inflationary. Right now, what I'm seeing and hearing is a little bit of a stagflation concern."]

If the U.S. economy struggles, the economies of other countries will face even greater difficulties.

While the U.S. is forcing each country to find its own way, the international trade relationships are too intricately intertwined for that to be easy.

This is Park Il-jung from KBS News in New York.

-

-

박일중 기자 baikal@kbs.co.kr

박일중 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.