[Anchor]

During the first 100 days of the Trump administraion, our companies are facing unprecedented high tariffs, resulting in a significant impact on exports.

The bigger problem is that this 'uncertainty' is expected to continue for the time being, leading many companies to adopt a wait-and-see approach.

Reporter Park Kyung-jun has more.

[Report]

In the first quarter of this year, Hyundai Motor achieved its highest-ever performance with 44 trillion won.

In the U.S., it also sold the most vehicles last month.

However, in the second quarter, it opted for a strategy of relying on inventory in the U.S. market.

[Lee Seung-jo/Head of Hyundai Motor's Planning and Finance Division/Apr. 24: "We pushed for maximum shipments by the end of March. As for completed vehicles, we currently have 3.1 months of inventory in North America, and for parts, the inventory is even longer...."]

This is due to the 'uncertainty' caused by fluctuating tariff policies.

Samsung and LG are also planning to buy time by maximizing the use of their existing production facilities in the U.S.

They may expand local investments, but there are many factors to consider, such as investment costs and production costs.

Although not immediately, they are also considering raising product prices in the U.S. and relocating production bases to diversify tariff risks.

Rival companies POSCO and Hyundai Steel have joined forces to build a steel mill in the U.S.

In light of the U.S.-China power competition, more companies are seeking to diversify investments to countries like India instead of China.

[Jang Sang-sik/Director of the International Trade and Commerce Research Institute at the Korea International Trade Association: "We need to respond to China's control over key minerals and the U.S. excluding China. Companies are looking to secure their supply chains or diversify them...."]

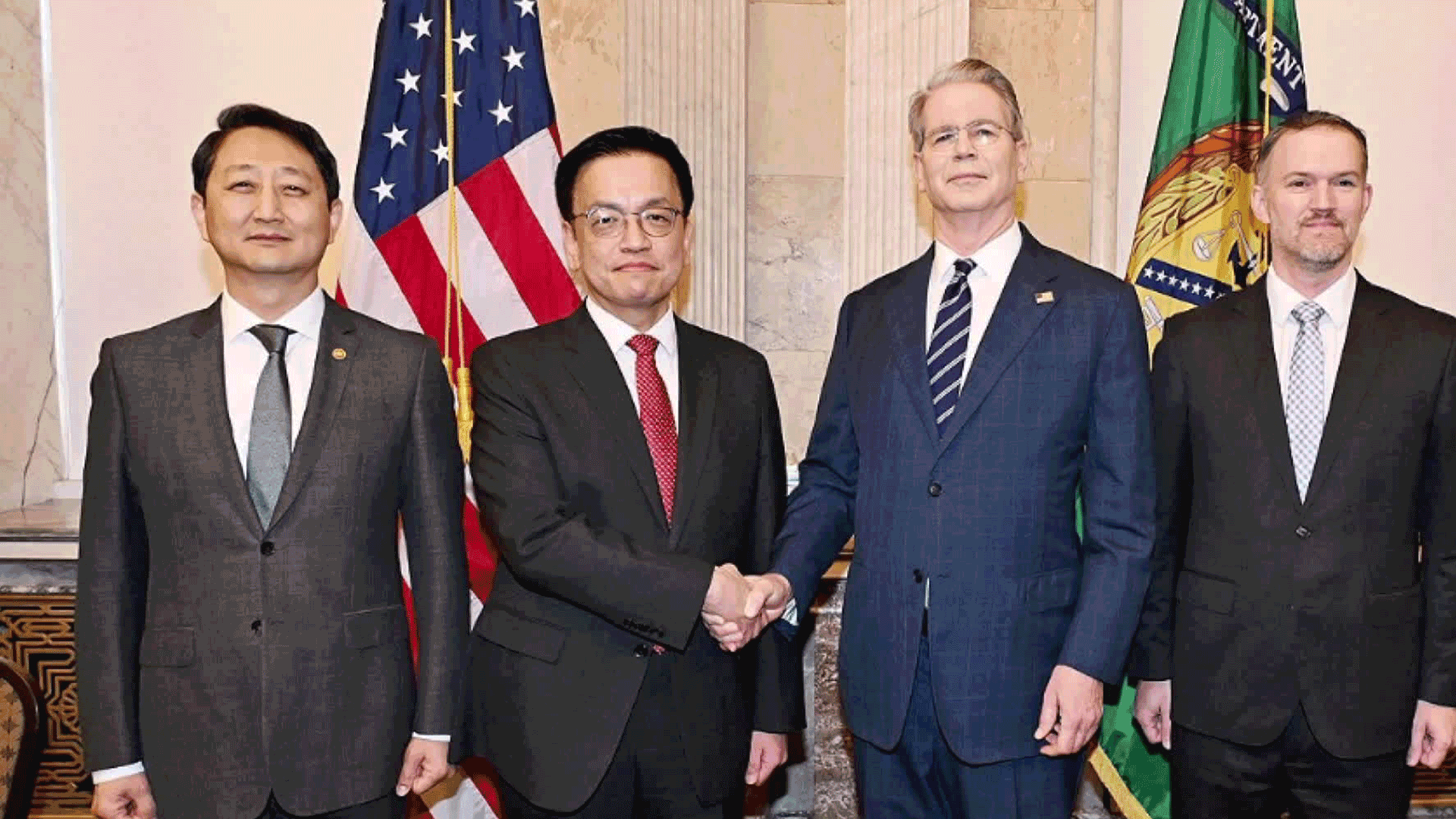

The government is accelerating tariff negotiations with the U.S.

Among the four agendas set in last week's negotiations, six working groups will be formed to cover three areas—tariffs, non-tariffs, and economic security—and will begin meetings in earnest starting next week.

Exchange rates will be discussed separately among financial authorities.

The government has stated that the final conclusion of the negotiations will be made by the next administration after the presidential election.

This is KBS News, Park Kyung-jun.

During the first 100 days of the Trump administraion, our companies are facing unprecedented high tariffs, resulting in a significant impact on exports.

The bigger problem is that this 'uncertainty' is expected to continue for the time being, leading many companies to adopt a wait-and-see approach.

Reporter Park Kyung-jun has more.

[Report]

In the first quarter of this year, Hyundai Motor achieved its highest-ever performance with 44 trillion won.

In the U.S., it also sold the most vehicles last month.

However, in the second quarter, it opted for a strategy of relying on inventory in the U.S. market.

[Lee Seung-jo/Head of Hyundai Motor's Planning and Finance Division/Apr. 24: "We pushed for maximum shipments by the end of March. As for completed vehicles, we currently have 3.1 months of inventory in North America, and for parts, the inventory is even longer...."]

This is due to the 'uncertainty' caused by fluctuating tariff policies.

Samsung and LG are also planning to buy time by maximizing the use of their existing production facilities in the U.S.

They may expand local investments, but there are many factors to consider, such as investment costs and production costs.

Although not immediately, they are also considering raising product prices in the U.S. and relocating production bases to diversify tariff risks.

Rival companies POSCO and Hyundai Steel have joined forces to build a steel mill in the U.S.

In light of the U.S.-China power competition, more companies are seeking to diversify investments to countries like India instead of China.

[Jang Sang-sik/Director of the International Trade and Commerce Research Institute at the Korea International Trade Association: "We need to respond to China's control over key minerals and the U.S. excluding China. Companies are looking to secure their supply chains or diversify them...."]

The government is accelerating tariff negotiations with the U.S.

Among the four agendas set in last week's negotiations, six working groups will be formed to cover three areas—tariffs, non-tariffs, and economic security—and will begin meetings in earnest starting next week.

Exchange rates will be discussed separately among financial authorities.

The government has stated that the final conclusion of the negotiations will be made by the next administration after the presidential election.

This is KBS News, Park Kyung-jun.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Companies wait amid uncertainty

-

- 입력 2025-04-28 23:56:57

[Anchor]

During the first 100 days of the Trump administraion, our companies are facing unprecedented high tariffs, resulting in a significant impact on exports.

The bigger problem is that this 'uncertainty' is expected to continue for the time being, leading many companies to adopt a wait-and-see approach.

Reporter Park Kyung-jun has more.

[Report]

In the first quarter of this year, Hyundai Motor achieved its highest-ever performance with 44 trillion won.

In the U.S., it also sold the most vehicles last month.

However, in the second quarter, it opted for a strategy of relying on inventory in the U.S. market.

[Lee Seung-jo/Head of Hyundai Motor's Planning and Finance Division/Apr. 24: "We pushed for maximum shipments by the end of March. As for completed vehicles, we currently have 3.1 months of inventory in North America, and for parts, the inventory is even longer...."]

This is due to the 'uncertainty' caused by fluctuating tariff policies.

Samsung and LG are also planning to buy time by maximizing the use of their existing production facilities in the U.S.

They may expand local investments, but there are many factors to consider, such as investment costs and production costs.

Although not immediately, they are also considering raising product prices in the U.S. and relocating production bases to diversify tariff risks.

Rival companies POSCO and Hyundai Steel have joined forces to build a steel mill in the U.S.

In light of the U.S.-China power competition, more companies are seeking to diversify investments to countries like India instead of China.

[Jang Sang-sik/Director of the International Trade and Commerce Research Institute at the Korea International Trade Association: "We need to respond to China's control over key minerals and the U.S. excluding China. Companies are looking to secure their supply chains or diversify them...."]

The government is accelerating tariff negotiations with the U.S.

Among the four agendas set in last week's negotiations, six working groups will be formed to cover three areas—tariffs, non-tariffs, and economic security—and will begin meetings in earnest starting next week.

Exchange rates will be discussed separately among financial authorities.

The government has stated that the final conclusion of the negotiations will be made by the next administration after the presidential election.

This is KBS News, Park Kyung-jun.

During the first 100 days of the Trump administraion, our companies are facing unprecedented high tariffs, resulting in a significant impact on exports.

The bigger problem is that this 'uncertainty' is expected to continue for the time being, leading many companies to adopt a wait-and-see approach.

Reporter Park Kyung-jun has more.

[Report]

In the first quarter of this year, Hyundai Motor achieved its highest-ever performance with 44 trillion won.

In the U.S., it also sold the most vehicles last month.

However, in the second quarter, it opted for a strategy of relying on inventory in the U.S. market.

[Lee Seung-jo/Head of Hyundai Motor's Planning and Finance Division/Apr. 24: "We pushed for maximum shipments by the end of March. As for completed vehicles, we currently have 3.1 months of inventory in North America, and for parts, the inventory is even longer...."]

This is due to the 'uncertainty' caused by fluctuating tariff policies.

Samsung and LG are also planning to buy time by maximizing the use of their existing production facilities in the U.S.

They may expand local investments, but there are many factors to consider, such as investment costs and production costs.

Although not immediately, they are also considering raising product prices in the U.S. and relocating production bases to diversify tariff risks.

Rival companies POSCO and Hyundai Steel have joined forces to build a steel mill in the U.S.

In light of the U.S.-China power competition, more companies are seeking to diversify investments to countries like India instead of China.

[Jang Sang-sik/Director of the International Trade and Commerce Research Institute at the Korea International Trade Association: "We need to respond to China's control over key minerals and the U.S. excluding China. Companies are looking to secure their supply chains or diversify them...."]

The government is accelerating tariff negotiations with the U.S.

Among the four agendas set in last week's negotiations, six working groups will be formed to cover three areas—tariffs, non-tariffs, and economic security—and will begin meetings in earnest starting next week.

Exchange rates will be discussed separately among financial authorities.

The government has stated that the final conclusion of the negotiations will be made by the next administration after the presidential election.

This is KBS News, Park Kyung-jun.

-

-

박경준 기자 kjpark@kbs.co.kr

박경준 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.