[Anchor]

Recently, many people may feel burdened by the rising premiums of health insurance.

Depending on the product, premiums have increased by 5% to 15% per year.

With about 40 million subscribers and an increase in claims, insurance companies have faced greater losses.

However, an investigation by the Board of Audit and Inspection revealed that fraudulent insurance claims are a serious issue.

Moreover, it was found that this practice not only harms insurance companies but also places a significant burden on our chronically deficit health insurance finances.

Reporter Shin Ji-hye has the story.

[Report]

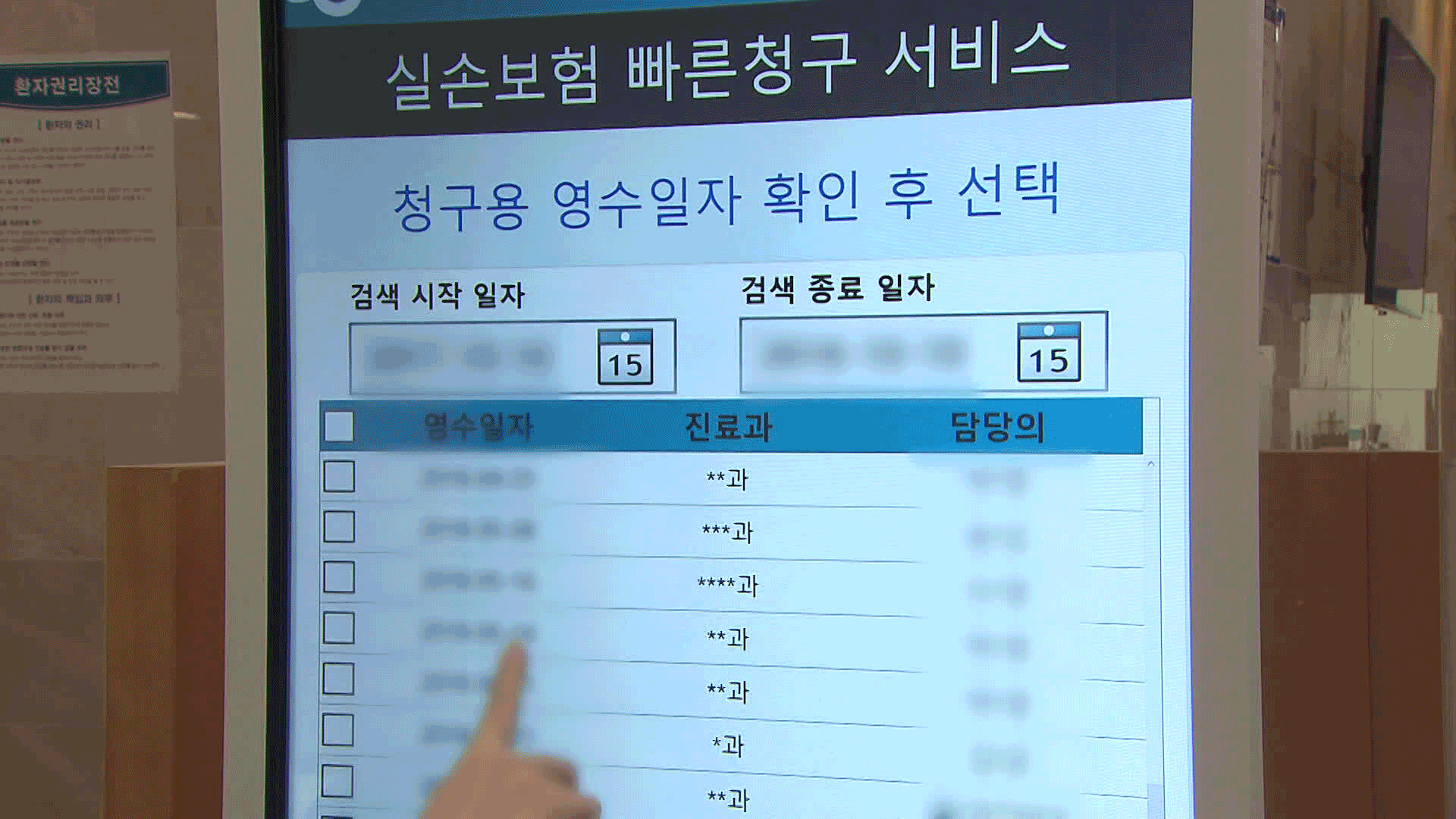

At a plastic surgery clinic in Seoul, there were excessively high diagnoses of rhinitis compared to the medical specialties offered.

The Board of Audit and Inspection found that even for cosmetic purposes, fake diagnoses were made to allow patients to receive health insurance payments for nose surgeries.

Patients claimed expenses for rhinitis surgery, but the hospital did not send treatment records to the insurance agency.

Such 'unreported' insurance payments amounted to 7.3 million cases over five years.

Most of these are suspected to be insurance fraud.

Cases where the disease name was changed to claim insurance accounted for 46% of the total.

In total, 50 million cases were confirmed over five years, with more than 10 trillion won in insurance payments claimed.

This 'insurance premium skimming' leads to losses for insurance companies and a rapid increase in the burden on subscribers.

The problem is that it also causes losses in the health insurance finances, which are already in deficit, amounting to trillions of won.

As patients visit hospitals more frequently to receive insurance payments, the number of covered treatments increases, and the health insurance premiums that the agency must pay to hospitals also rise.

In fact, health insurance subscribers visited hospitals about 2.3 to 7 days more per year than those without insurance.

The health insurance expenditures resulting from this are estimated to be between 3.8 trillion and 10.9 trillion won annually.

The Board of Audit and Inspection pointed out that these are financial expenditures that would not have occurred if health insurance subscribers had received treatment at the same level as non-subscribers.

The Board of Audit and Inspection reported this as a problem arising from the lack of information sharing between the national health insurance service and insurance companies, and instructed the Ministry of Health and Welfare and the Financial Services Commission to come up with measures.

KBS News, Shin Ji-hye.

Recently, many people may feel burdened by the rising premiums of health insurance.

Depending on the product, premiums have increased by 5% to 15% per year.

With about 40 million subscribers and an increase in claims, insurance companies have faced greater losses.

However, an investigation by the Board of Audit and Inspection revealed that fraudulent insurance claims are a serious issue.

Moreover, it was found that this practice not only harms insurance companies but also places a significant burden on our chronically deficit health insurance finances.

Reporter Shin Ji-hye has the story.

[Report]

At a plastic surgery clinic in Seoul, there were excessively high diagnoses of rhinitis compared to the medical specialties offered.

The Board of Audit and Inspection found that even for cosmetic purposes, fake diagnoses were made to allow patients to receive health insurance payments for nose surgeries.

Patients claimed expenses for rhinitis surgery, but the hospital did not send treatment records to the insurance agency.

Such 'unreported' insurance payments amounted to 7.3 million cases over five years.

Most of these are suspected to be insurance fraud.

Cases where the disease name was changed to claim insurance accounted for 46% of the total.

In total, 50 million cases were confirmed over five years, with more than 10 trillion won in insurance payments claimed.

This 'insurance premium skimming' leads to losses for insurance companies and a rapid increase in the burden on subscribers.

The problem is that it also causes losses in the health insurance finances, which are already in deficit, amounting to trillions of won.

As patients visit hospitals more frequently to receive insurance payments, the number of covered treatments increases, and the health insurance premiums that the agency must pay to hospitals also rise.

In fact, health insurance subscribers visited hospitals about 2.3 to 7 days more per year than those without insurance.

The health insurance expenditures resulting from this are estimated to be between 3.8 trillion and 10.9 trillion won annually.

The Board of Audit and Inspection pointed out that these are financial expenditures that would not have occurred if health insurance subscribers had received treatment at the same level as non-subscribers.

The Board of Audit and Inspection reported this as a problem arising from the lack of information sharing between the national health insurance service and insurance companies, and instructed the Ministry of Health and Welfare and the Financial Services Commission to come up with measures.

KBS News, Shin Ji-hye.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- False claims strain insurers

-

- 입력 2025-05-15 00:51:24

[Anchor]

Recently, many people may feel burdened by the rising premiums of health insurance.

Depending on the product, premiums have increased by 5% to 15% per year.

With about 40 million subscribers and an increase in claims, insurance companies have faced greater losses.

However, an investigation by the Board of Audit and Inspection revealed that fraudulent insurance claims are a serious issue.

Moreover, it was found that this practice not only harms insurance companies but also places a significant burden on our chronically deficit health insurance finances.

Reporter Shin Ji-hye has the story.

[Report]

At a plastic surgery clinic in Seoul, there were excessively high diagnoses of rhinitis compared to the medical specialties offered.

The Board of Audit and Inspection found that even for cosmetic purposes, fake diagnoses were made to allow patients to receive health insurance payments for nose surgeries.

Patients claimed expenses for rhinitis surgery, but the hospital did not send treatment records to the insurance agency.

Such 'unreported' insurance payments amounted to 7.3 million cases over five years.

Most of these are suspected to be insurance fraud.

Cases where the disease name was changed to claim insurance accounted for 46% of the total.

In total, 50 million cases were confirmed over five years, with more than 10 trillion won in insurance payments claimed.

This 'insurance premium skimming' leads to losses for insurance companies and a rapid increase in the burden on subscribers.

The problem is that it also causes losses in the health insurance finances, which are already in deficit, amounting to trillions of won.

As patients visit hospitals more frequently to receive insurance payments, the number of covered treatments increases, and the health insurance premiums that the agency must pay to hospitals also rise.

In fact, health insurance subscribers visited hospitals about 2.3 to 7 days more per year than those without insurance.

The health insurance expenditures resulting from this are estimated to be between 3.8 trillion and 10.9 trillion won annually.

The Board of Audit and Inspection pointed out that these are financial expenditures that would not have occurred if health insurance subscribers had received treatment at the same level as non-subscribers.

The Board of Audit and Inspection reported this as a problem arising from the lack of information sharing between the national health insurance service and insurance companies, and instructed the Ministry of Health and Welfare and the Financial Services Commission to come up with measures.

KBS News, Shin Ji-hye.

Recently, many people may feel burdened by the rising premiums of health insurance.

Depending on the product, premiums have increased by 5% to 15% per year.

With about 40 million subscribers and an increase in claims, insurance companies have faced greater losses.

However, an investigation by the Board of Audit and Inspection revealed that fraudulent insurance claims are a serious issue.

Moreover, it was found that this practice not only harms insurance companies but also places a significant burden on our chronically deficit health insurance finances.

Reporter Shin Ji-hye has the story.

[Report]

At a plastic surgery clinic in Seoul, there were excessively high diagnoses of rhinitis compared to the medical specialties offered.

The Board of Audit and Inspection found that even for cosmetic purposes, fake diagnoses were made to allow patients to receive health insurance payments for nose surgeries.

Patients claimed expenses for rhinitis surgery, but the hospital did not send treatment records to the insurance agency.

Such 'unreported' insurance payments amounted to 7.3 million cases over five years.

Most of these are suspected to be insurance fraud.

Cases where the disease name was changed to claim insurance accounted for 46% of the total.

In total, 50 million cases were confirmed over five years, with more than 10 trillion won in insurance payments claimed.

This 'insurance premium skimming' leads to losses for insurance companies and a rapid increase in the burden on subscribers.

The problem is that it also causes losses in the health insurance finances, which are already in deficit, amounting to trillions of won.

As patients visit hospitals more frequently to receive insurance payments, the number of covered treatments increases, and the health insurance premiums that the agency must pay to hospitals also rise.

In fact, health insurance subscribers visited hospitals about 2.3 to 7 days more per year than those without insurance.

The health insurance expenditures resulting from this are estimated to be between 3.8 trillion and 10.9 trillion won annually.

The Board of Audit and Inspection pointed out that these are financial expenditures that would not have occurred if health insurance subscribers had received treatment at the same level as non-subscribers.

The Board of Audit and Inspection reported this as a problem arising from the lack of information sharing between the national health insurance service and insurance companies, and instructed the Ministry of Health and Welfare and the Financial Services Commission to come up with measures.

KBS News, Shin Ji-hye.

-

-

신지혜 기자 new@kbs.co.kr

신지혜 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.