[Anchor]

When tensions rise in the Middle East, global oil prices tend to jump.

Prices are now hovering above 80 dollars per barrel.

The Korean won-dollar exchange rate has also surged.

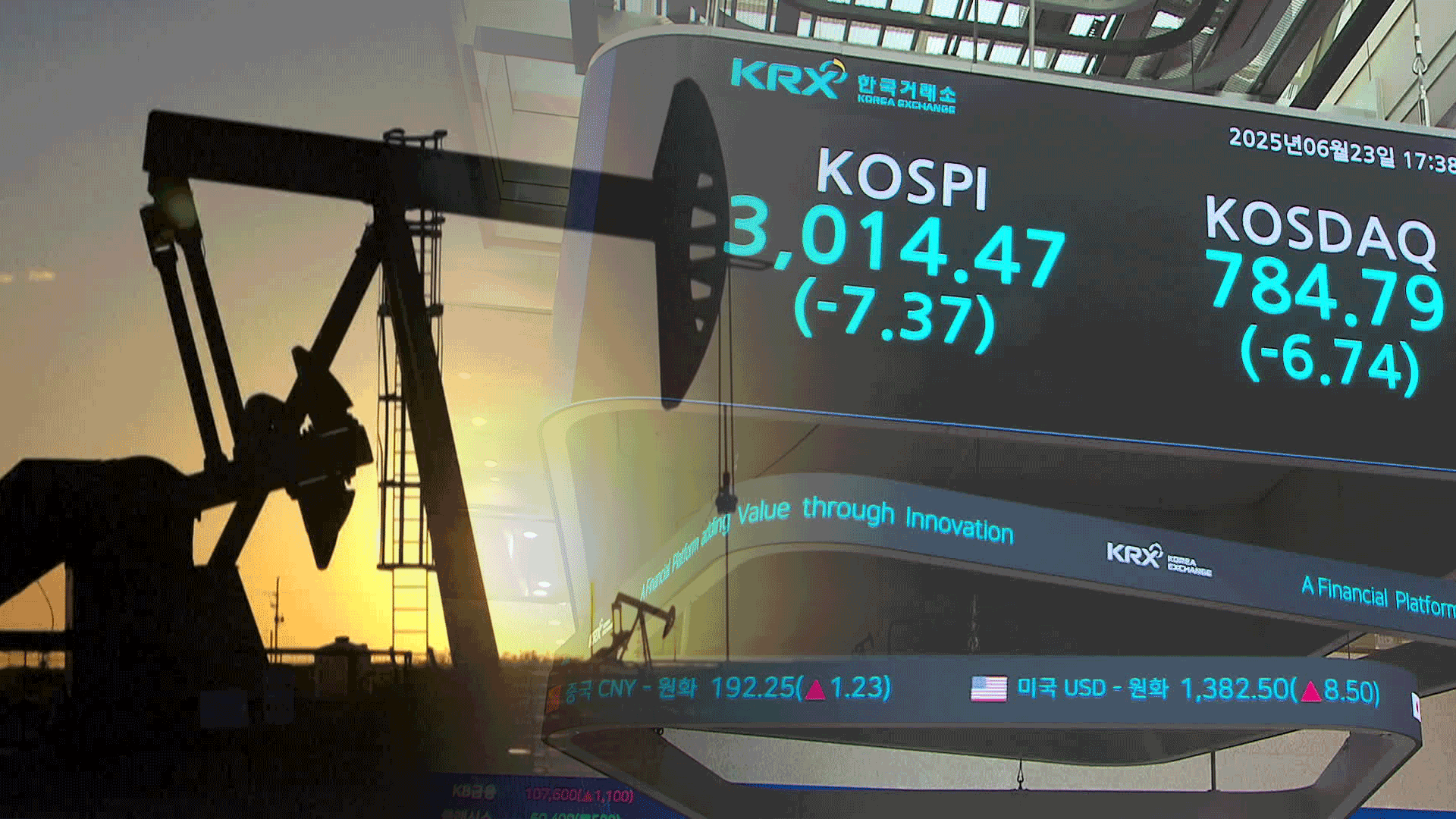

The KOSPI wavered, with the 3,000-point mark under threat.

Reporter Jeong Jae-woo has the details.

[Report]

Concerns over a possible blockade of the Strait of Hormuz pushed oil prices higher.

Brent crude futures jumped more than 5% right after the market opened.

For the first time since mid-January, prices rose above 80 dollars per barrel.

Although the gains were later pared back, prices have climbed about 10% over the past ten days since Israel launched airstrikes on June 13.

West Texas Intermediate (WTI) futures also rose over 3%, exceeding 76 dollars per barrel.

The KOSPI’s upward momentum also came to a halt.

Right after the market opened, foreign and institutional investors rushed to sell, dragging the index down to the 2,970 level.

Individual investors stepped in to buy, helping the index close above the 3,000 mark.

[Park Sang-hyun/Senior Research Fellow, IM Securities: “Since the stock market has been strong overall, it could have reflected that trend, and the fact that no aggressive statements or breaking news have emerged just yet…”]

The weekly closing price of the won-dollar exchange rate was 1,384 won per dollar.

That’s the highest level since Mar. 21.

[Moon Jeong-hee/Senior Researcher, KB Kookmin Bank: "Due to sensitivity to oil imports, the rising instability in the Middle East likely led to stronger demand for the dollar…”]

Whether Iran’s threat to block the Strait of Hormuz is mere rhetoric or becomes reality is expected to be the biggest variable for both stock prices and the exchange rate in the near term.

This is KBS News, Jeong Jae-woo.

When tensions rise in the Middle East, global oil prices tend to jump.

Prices are now hovering above 80 dollars per barrel.

The Korean won-dollar exchange rate has also surged.

The KOSPI wavered, with the 3,000-point mark under threat.

Reporter Jeong Jae-woo has the details.

[Report]

Concerns over a possible blockade of the Strait of Hormuz pushed oil prices higher.

Brent crude futures jumped more than 5% right after the market opened.

For the first time since mid-January, prices rose above 80 dollars per barrel.

Although the gains were later pared back, prices have climbed about 10% over the past ten days since Israel launched airstrikes on June 13.

West Texas Intermediate (WTI) futures also rose over 3%, exceeding 76 dollars per barrel.

The KOSPI’s upward momentum also came to a halt.

Right after the market opened, foreign and institutional investors rushed to sell, dragging the index down to the 2,970 level.

Individual investors stepped in to buy, helping the index close above the 3,000 mark.

[Park Sang-hyun/Senior Research Fellow, IM Securities: “Since the stock market has been strong overall, it could have reflected that trend, and the fact that no aggressive statements or breaking news have emerged just yet…”]

The weekly closing price of the won-dollar exchange rate was 1,384 won per dollar.

That’s the highest level since Mar. 21.

[Moon Jeong-hee/Senior Researcher, KB Kookmin Bank: "Due to sensitivity to oil imports, the rising instability in the Middle East likely led to stronger demand for the dollar…”]

Whether Iran’s threat to block the Strait of Hormuz is mere rhetoric or becomes reality is expected to be the biggest variable for both stock prices and the exchange rate in the near term.

This is KBS News, Jeong Jae-woo.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Oil jitters shake markets

-

- 입력 2025-06-23 23:48:48

[Anchor]

When tensions rise in the Middle East, global oil prices tend to jump.

Prices are now hovering above 80 dollars per barrel.

The Korean won-dollar exchange rate has also surged.

The KOSPI wavered, with the 3,000-point mark under threat.

Reporter Jeong Jae-woo has the details.

[Report]

Concerns over a possible blockade of the Strait of Hormuz pushed oil prices higher.

Brent crude futures jumped more than 5% right after the market opened.

For the first time since mid-January, prices rose above 80 dollars per barrel.

Although the gains were later pared back, prices have climbed about 10% over the past ten days since Israel launched airstrikes on June 13.

West Texas Intermediate (WTI) futures also rose over 3%, exceeding 76 dollars per barrel.

The KOSPI’s upward momentum also came to a halt.

Right after the market opened, foreign and institutional investors rushed to sell, dragging the index down to the 2,970 level.

Individual investors stepped in to buy, helping the index close above the 3,000 mark.

[Park Sang-hyun/Senior Research Fellow, IM Securities: “Since the stock market has been strong overall, it could have reflected that trend, and the fact that no aggressive statements or breaking news have emerged just yet…”]

The weekly closing price of the won-dollar exchange rate was 1,384 won per dollar.

That’s the highest level since Mar. 21.

[Moon Jeong-hee/Senior Researcher, KB Kookmin Bank: "Due to sensitivity to oil imports, the rising instability in the Middle East likely led to stronger demand for the dollar…”]

Whether Iran’s threat to block the Strait of Hormuz is mere rhetoric or becomes reality is expected to be the biggest variable for both stock prices and the exchange rate in the near term.

This is KBS News, Jeong Jae-woo.

When tensions rise in the Middle East, global oil prices tend to jump.

Prices are now hovering above 80 dollars per barrel.

The Korean won-dollar exchange rate has also surged.

The KOSPI wavered, with the 3,000-point mark under threat.

Reporter Jeong Jae-woo has the details.

[Report]

Concerns over a possible blockade of the Strait of Hormuz pushed oil prices higher.

Brent crude futures jumped more than 5% right after the market opened.

For the first time since mid-January, prices rose above 80 dollars per barrel.

Although the gains were later pared back, prices have climbed about 10% over the past ten days since Israel launched airstrikes on June 13.

West Texas Intermediate (WTI) futures also rose over 3%, exceeding 76 dollars per barrel.

The KOSPI’s upward momentum also came to a halt.

Right after the market opened, foreign and institutional investors rushed to sell, dragging the index down to the 2,970 level.

Individual investors stepped in to buy, helping the index close above the 3,000 mark.

[Park Sang-hyun/Senior Research Fellow, IM Securities: “Since the stock market has been strong overall, it could have reflected that trend, and the fact that no aggressive statements or breaking news have emerged just yet…”]

The weekly closing price of the won-dollar exchange rate was 1,384 won per dollar.

That’s the highest level since Mar. 21.

[Moon Jeong-hee/Senior Researcher, KB Kookmin Bank: "Due to sensitivity to oil imports, the rising instability in the Middle East likely led to stronger demand for the dollar…”]

Whether Iran’s threat to block the Strait of Hormuz is mere rhetoric or becomes reality is expected to be the biggest variable for both stock prices and the exchange rate in the near term.

This is KBS News, Jeong Jae-woo.

-

-

정재우 기자 jjw@kbs.co.kr

정재우 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.