Impact of tightened housing loans

입력 2025.06.30 (02:19)

수정 2025.06.30 (10:27)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

Let's take a look at the impact of the latest tightened loan regulations that went into effect yesterday (28th).

An analysis shows that three out of four apartments in Seoul are directly hit by the reduction in loans.

While the immediate crisis may be contained, if supply concerns are not resolved, Seoul's housing prices could rebound at any time.

It seems that supply measures in the metropolitan area are key.

Reporter Park Chan has the story.

[Report]

This is an apartment set to go on pre-sale next month.

Located in Yeongdeungpo, Seoul, it has over 650 units.

Until the day before yesterday (Jun. 27), it was possible to secure housing loans up to 70% of the property price.

If the sale price of 1.6 billion won is applied to an 84-square-meter unit, it was possible to borrow up to 1.1 billion won, provided the borrower's income could support the total debt service ratio (DSR).

From now on, the maximum loan amount will be 600 million won.

The loan amount has decreased by up to 500 million won.

It is estimated that three out of four apartments in Seoul have seen a reduction in the loan amount.

Regionally, 18 out of the 25 districts in Seoul are affected.

[Yoon Ji-hae/Head of Research Lab, Real Estate R114: "In the three districts of Gangnam or the Han River belt, the price and transaction volume may significantly shrink due to the reduction in (loan) limits."]

Although the previously surging housing prices in Seoul appear to have been temporarily contained, no concrete measures have been introduced to address the other factor driving the rapid price increase: a supply shortage.

The number of new housing units in the metropolitan area is expected to drop from 140,000 this year to 100,000 next year, with only about 20,000 units in Seoul.

If supply does not increase in Seoul or in areas closely adjacent to it, the potential for a price surge remains significant.

[Yoon Soo-min/Real Estate Expert, NH Nonghyup Bank: "Expecting (the effect of the loan regulations) to be long-lasting or significant seems to be unrealistic."]

Recently, the National Planning Commission has called for an expansion of supply through means other than new towns, and the government is placing more emphasis on supply measures.

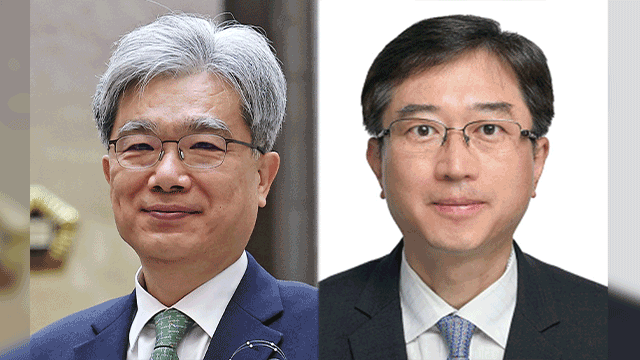

However, the Minister of Land, Infrastructure and Transport, the relevant ministry, was not included in today's (Jun. 29) minister appointments.

Professor Lee Sang-gyeong has been appointed as the Vice Minister of Land, Infrastructure and Transport, which is expected to strengthen the public-led supply expansion policy.

This is KBS News, Park Chan.

Let's take a look at the impact of the latest tightened loan regulations that went into effect yesterday (28th).

An analysis shows that three out of four apartments in Seoul are directly hit by the reduction in loans.

While the immediate crisis may be contained, if supply concerns are not resolved, Seoul's housing prices could rebound at any time.

It seems that supply measures in the metropolitan area are key.

Reporter Park Chan has the story.

[Report]

This is an apartment set to go on pre-sale next month.

Located in Yeongdeungpo, Seoul, it has over 650 units.

Until the day before yesterday (Jun. 27), it was possible to secure housing loans up to 70% of the property price.

If the sale price of 1.6 billion won is applied to an 84-square-meter unit, it was possible to borrow up to 1.1 billion won, provided the borrower's income could support the total debt service ratio (DSR).

From now on, the maximum loan amount will be 600 million won.

The loan amount has decreased by up to 500 million won.

It is estimated that three out of four apartments in Seoul have seen a reduction in the loan amount.

Regionally, 18 out of the 25 districts in Seoul are affected.

[Yoon Ji-hae/Head of Research Lab, Real Estate R114: "In the three districts of Gangnam or the Han River belt, the price and transaction volume may significantly shrink due to the reduction in (loan) limits."]

Although the previously surging housing prices in Seoul appear to have been temporarily contained, no concrete measures have been introduced to address the other factor driving the rapid price increase: a supply shortage.

The number of new housing units in the metropolitan area is expected to drop from 140,000 this year to 100,000 next year, with only about 20,000 units in Seoul.

If supply does not increase in Seoul or in areas closely adjacent to it, the potential for a price surge remains significant.

[Yoon Soo-min/Real Estate Expert, NH Nonghyup Bank: "Expecting (the effect of the loan regulations) to be long-lasting or significant seems to be unrealistic."]

Recently, the National Planning Commission has called for an expansion of supply through means other than new towns, and the government is placing more emphasis on supply measures.

However, the Minister of Land, Infrastructure and Transport, the relevant ministry, was not included in today's (Jun. 29) minister appointments.

Professor Lee Sang-gyeong has been appointed as the Vice Minister of Land, Infrastructure and Transport, which is expected to strengthen the public-led supply expansion policy.

This is KBS News, Park Chan.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Impact of tightened housing loans

-

- 입력 2025-06-30 02:19:33

- 수정2025-06-30 10:27:08

[Anchor]

Let's take a look at the impact of the latest tightened loan regulations that went into effect yesterday (28th).

An analysis shows that three out of four apartments in Seoul are directly hit by the reduction in loans.

While the immediate crisis may be contained, if supply concerns are not resolved, Seoul's housing prices could rebound at any time.

It seems that supply measures in the metropolitan area are key.

Reporter Park Chan has the story.

[Report]

This is an apartment set to go on pre-sale next month.

Located in Yeongdeungpo, Seoul, it has over 650 units.

Until the day before yesterday (Jun. 27), it was possible to secure housing loans up to 70% of the property price.

If the sale price of 1.6 billion won is applied to an 84-square-meter unit, it was possible to borrow up to 1.1 billion won, provided the borrower's income could support the total debt service ratio (DSR).

From now on, the maximum loan amount will be 600 million won.

The loan amount has decreased by up to 500 million won.

It is estimated that three out of four apartments in Seoul have seen a reduction in the loan amount.

Regionally, 18 out of the 25 districts in Seoul are affected.

[Yoon Ji-hae/Head of Research Lab, Real Estate R114: "In the three districts of Gangnam or the Han River belt, the price and transaction volume may significantly shrink due to the reduction in (loan) limits."]

Although the previously surging housing prices in Seoul appear to have been temporarily contained, no concrete measures have been introduced to address the other factor driving the rapid price increase: a supply shortage.

The number of new housing units in the metropolitan area is expected to drop from 140,000 this year to 100,000 next year, with only about 20,000 units in Seoul.

If supply does not increase in Seoul or in areas closely adjacent to it, the potential for a price surge remains significant.

[Yoon Soo-min/Real Estate Expert, NH Nonghyup Bank: "Expecting (the effect of the loan regulations) to be long-lasting or significant seems to be unrealistic."]

Recently, the National Planning Commission has called for an expansion of supply through means other than new towns, and the government is placing more emphasis on supply measures.

However, the Minister of Land, Infrastructure and Transport, the relevant ministry, was not included in today's (Jun. 29) minister appointments.

Professor Lee Sang-gyeong has been appointed as the Vice Minister of Land, Infrastructure and Transport, which is expected to strengthen the public-led supply expansion policy.

This is KBS News, Park Chan.

Let's take a look at the impact of the latest tightened loan regulations that went into effect yesterday (28th).

An analysis shows that three out of four apartments in Seoul are directly hit by the reduction in loans.

While the immediate crisis may be contained, if supply concerns are not resolved, Seoul's housing prices could rebound at any time.

It seems that supply measures in the metropolitan area are key.

Reporter Park Chan has the story.

[Report]

This is an apartment set to go on pre-sale next month.

Located in Yeongdeungpo, Seoul, it has over 650 units.

Until the day before yesterday (Jun. 27), it was possible to secure housing loans up to 70% of the property price.

If the sale price of 1.6 billion won is applied to an 84-square-meter unit, it was possible to borrow up to 1.1 billion won, provided the borrower's income could support the total debt service ratio (DSR).

From now on, the maximum loan amount will be 600 million won.

The loan amount has decreased by up to 500 million won.

It is estimated that three out of four apartments in Seoul have seen a reduction in the loan amount.

Regionally, 18 out of the 25 districts in Seoul are affected.

[Yoon Ji-hae/Head of Research Lab, Real Estate R114: "In the three districts of Gangnam or the Han River belt, the price and transaction volume may significantly shrink due to the reduction in (loan) limits."]

Although the previously surging housing prices in Seoul appear to have been temporarily contained, no concrete measures have been introduced to address the other factor driving the rapid price increase: a supply shortage.

The number of new housing units in the metropolitan area is expected to drop from 140,000 this year to 100,000 next year, with only about 20,000 units in Seoul.

If supply does not increase in Seoul or in areas closely adjacent to it, the potential for a price surge remains significant.

[Yoon Soo-min/Real Estate Expert, NH Nonghyup Bank: "Expecting (the effect of the loan regulations) to be long-lasting or significant seems to be unrealistic."]

Recently, the National Planning Commission has called for an expansion of supply through means other than new towns, and the government is placing more emphasis on supply measures.

However, the Minister of Land, Infrastructure and Transport, the relevant ministry, was not included in today's (Jun. 29) minister appointments.

Professor Lee Sang-gyeong has been appointed as the Vice Minister of Land, Infrastructure and Transport, which is expected to strengthen the public-led supply expansion policy.

This is KBS News, Park Chan.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.