[Anchor]

Despite the uncertainty caused by U.S. tariff policies, U.S. stocks and cryptocurrency values continue to show strength.

President Trump claims that it is all thanks to the tariff policies and is pressuring for a cut in the benchmark interest rate.

Kim Kyung-soo reports from Washington.

[Report]

The S&P 500 index and the Nasdaq index have reached all-time highs.

In particular, Nvidia has surpassed a market capitalization of $4 trillion based on closing prices, ranking first in the world.

The stock market has developed resilience to the fluctuating tariff uncertainties, and the optimism of investors fueled by the AI boom has driven up stock prices.

[Melissa Brown/Head of Investment Decision Research at SimCorp: "We're just about to start earnings season or if we haven't already started it, and I think investors are reasonably positive about the outlook for earnings."]

The cryptocurrency Bitcoin is also continuing its upward trend, breaking its all-time highs day after day.

The previously subdued appetite for risk assets is being revived.

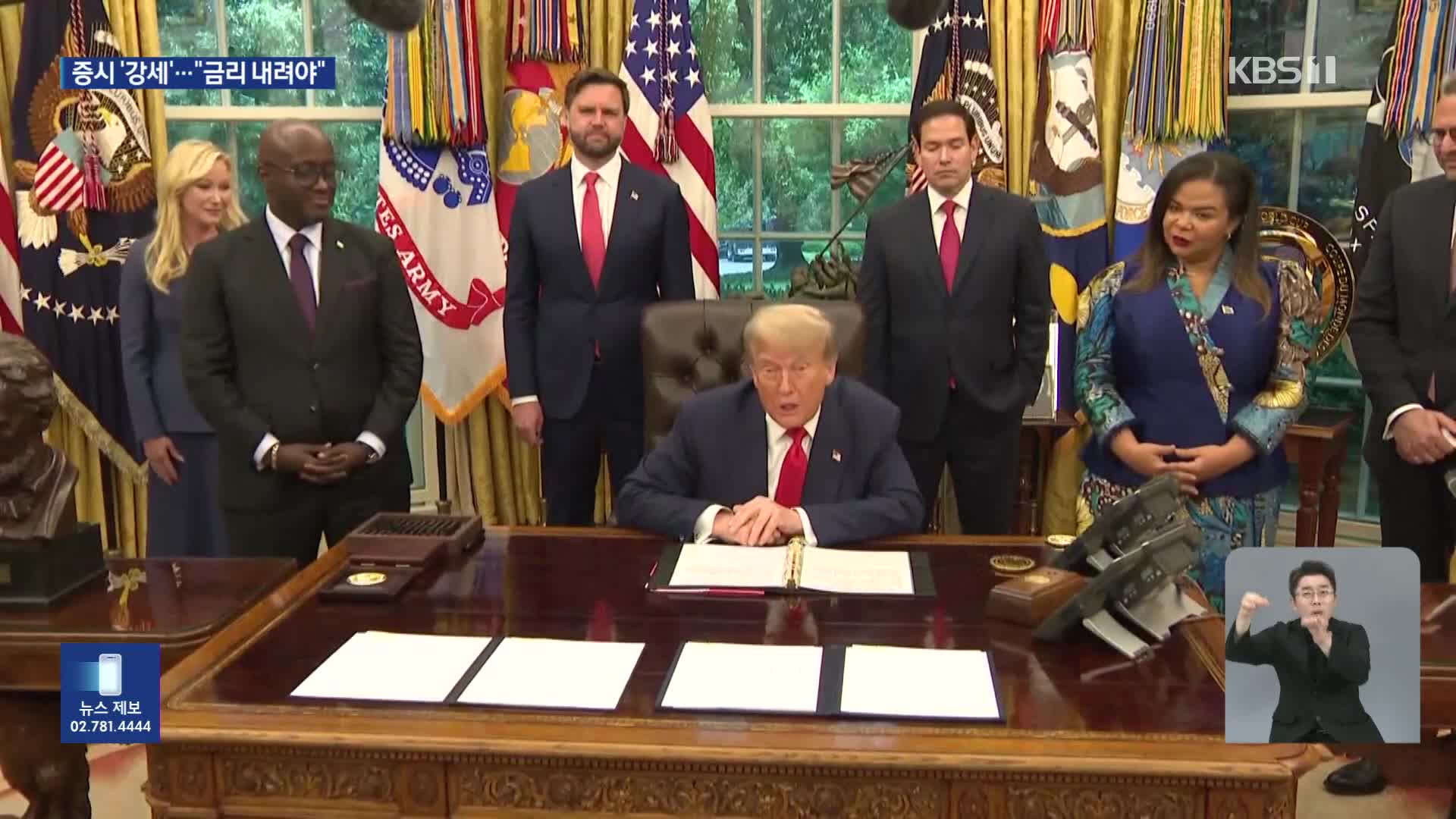

President Trump stated that this is all thanks to him.

Trump wrote that after the introduction of massive tariffs, tech stocks, industrial stocks, and the Nasdaq have reached record highs, and cryptocurrencies are breaking through ceilings.

He then ramped up pressure on the Federal Reserve, demanding a cut to the benchmark interest rate.

He has been calling for the resignation of Fed Chair Powell, accompanied by insults claiming he is slow and foolish.

[Donald Trump/U.S. President/July 8: "We should get somebody in there that is going to lower interest rates. Why don't you call for his resignation?"]

As the interest rate decision meeting at the end of this month approaches, Trump's public pressure is expected to intensify.

However, forecasts suggest that the interest rate will remain unchanged.

This is due to the uncertainty surrounding tariff policies.

This is Kim Kyung-soo from KBS News in Washington.

Despite the uncertainty caused by U.S. tariff policies, U.S. stocks and cryptocurrency values continue to show strength.

President Trump claims that it is all thanks to the tariff policies and is pressuring for a cut in the benchmark interest rate.

Kim Kyung-soo reports from Washington.

[Report]

The S&P 500 index and the Nasdaq index have reached all-time highs.

In particular, Nvidia has surpassed a market capitalization of $4 trillion based on closing prices, ranking first in the world.

The stock market has developed resilience to the fluctuating tariff uncertainties, and the optimism of investors fueled by the AI boom has driven up stock prices.

[Melissa Brown/Head of Investment Decision Research at SimCorp: "We're just about to start earnings season or if we haven't already started it, and I think investors are reasonably positive about the outlook for earnings."]

The cryptocurrency Bitcoin is also continuing its upward trend, breaking its all-time highs day after day.

The previously subdued appetite for risk assets is being revived.

President Trump stated that this is all thanks to him.

Trump wrote that after the introduction of massive tariffs, tech stocks, industrial stocks, and the Nasdaq have reached record highs, and cryptocurrencies are breaking through ceilings.

He then ramped up pressure on the Federal Reserve, demanding a cut to the benchmark interest rate.

He has been calling for the resignation of Fed Chair Powell, accompanied by insults claiming he is slow and foolish.

[Donald Trump/U.S. President/July 8: "We should get somebody in there that is going to lower interest rates. Why don't you call for his resignation?"]

As the interest rate decision meeting at the end of this month approaches, Trump's public pressure is expected to intensify.

However, forecasts suggest that the interest rate will remain unchanged.

This is due to the uncertainty surrounding tariff policies.

This is Kim Kyung-soo from KBS News in Washington.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Markets soar, Trump demands cuts

-

- 입력 2025-07-12 00:06:27

[Anchor]

Despite the uncertainty caused by U.S. tariff policies, U.S. stocks and cryptocurrency values continue to show strength.

President Trump claims that it is all thanks to the tariff policies and is pressuring for a cut in the benchmark interest rate.

Kim Kyung-soo reports from Washington.

[Report]

The S&P 500 index and the Nasdaq index have reached all-time highs.

In particular, Nvidia has surpassed a market capitalization of $4 trillion based on closing prices, ranking first in the world.

The stock market has developed resilience to the fluctuating tariff uncertainties, and the optimism of investors fueled by the AI boom has driven up stock prices.

[Melissa Brown/Head of Investment Decision Research at SimCorp: "We're just about to start earnings season or if we haven't already started it, and I think investors are reasonably positive about the outlook for earnings."]

The cryptocurrency Bitcoin is also continuing its upward trend, breaking its all-time highs day after day.

The previously subdued appetite for risk assets is being revived.

President Trump stated that this is all thanks to him.

Trump wrote that after the introduction of massive tariffs, tech stocks, industrial stocks, and the Nasdaq have reached record highs, and cryptocurrencies are breaking through ceilings.

He then ramped up pressure on the Federal Reserve, demanding a cut to the benchmark interest rate.

He has been calling for the resignation of Fed Chair Powell, accompanied by insults claiming he is slow and foolish.

[Donald Trump/U.S. President/July 8: "We should get somebody in there that is going to lower interest rates. Why don't you call for his resignation?"]

As the interest rate decision meeting at the end of this month approaches, Trump's public pressure is expected to intensify.

However, forecasts suggest that the interest rate will remain unchanged.

This is due to the uncertainty surrounding tariff policies.

This is Kim Kyung-soo from KBS News in Washington.

Despite the uncertainty caused by U.S. tariff policies, U.S. stocks and cryptocurrency values continue to show strength.

President Trump claims that it is all thanks to the tariff policies and is pressuring for a cut in the benchmark interest rate.

Kim Kyung-soo reports from Washington.

[Report]

The S&P 500 index and the Nasdaq index have reached all-time highs.

In particular, Nvidia has surpassed a market capitalization of $4 trillion based on closing prices, ranking first in the world.

The stock market has developed resilience to the fluctuating tariff uncertainties, and the optimism of investors fueled by the AI boom has driven up stock prices.

[Melissa Brown/Head of Investment Decision Research at SimCorp: "We're just about to start earnings season or if we haven't already started it, and I think investors are reasonably positive about the outlook for earnings."]

The cryptocurrency Bitcoin is also continuing its upward trend, breaking its all-time highs day after day.

The previously subdued appetite for risk assets is being revived.

President Trump stated that this is all thanks to him.

Trump wrote that after the introduction of massive tariffs, tech stocks, industrial stocks, and the Nasdaq have reached record highs, and cryptocurrencies are breaking through ceilings.

He then ramped up pressure on the Federal Reserve, demanding a cut to the benchmark interest rate.

He has been calling for the resignation of Fed Chair Powell, accompanied by insults claiming he is slow and foolish.

[Donald Trump/U.S. President/July 8: "We should get somebody in there that is going to lower interest rates. Why don't you call for his resignation?"]

As the interest rate decision meeting at the end of this month approaches, Trump's public pressure is expected to intensify.

However, forecasts suggest that the interest rate will remain unchanged.

This is due to the uncertainty surrounding tariff policies.

This is Kim Kyung-soo from KBS News in Washington.

-

-

김경수 기자 bada@kbs.co.kr

김경수 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] “윤석열·김용현 등 공모해 군사상 이익 해쳐”<br>…외환죄 대신 일반이적죄 적용](/data/layer/904/2025/07/20250714_3VTJV3.jpg)

이 기사에 대한 의견을 남겨주세요.