[Anchor]

The abbreviation for the United States is U.S.

When you add a D, it becomes USD, which stands for dollar.

By adding one letter at a time, it becomes USDT and USDC.

These may sound unfamiliar, but they are famous virtual assets in the U.S. called 'Tether' and 'Circle.'

Recently, interest in these two coins has been heating up.

The biggest feature is 'price stability.'

1 Tether is always 1 dollar, and 1 Circle is also fixed at 1 dollar.

This is a world apart from 'Bitcoin,' the representative of virtual assets.

Today (7.14), 1 Bitcoin surpassed 120,000 dollars, setting another record high.

Compared to when it was the cheapest in the recent year, there is a 2.3 times difference.

If Bitcoin is like a stock with high volatility, Tether and Circle are like cash.

That’s why they are collectively referred to as 'stablecoins.'

Among them, the issuer of 'Circle' was listed on the U.S. stock market last month and immediately became the number one net purchase among domestic individual investors in overseas stocks.

Additionally, there is a growing movement to issue won-denominated stablecoins in South Korea.

Reporter Song Su-jin has the details.

[Report]

[“Can I help you with your order? (I would like an iced Americano.)”]

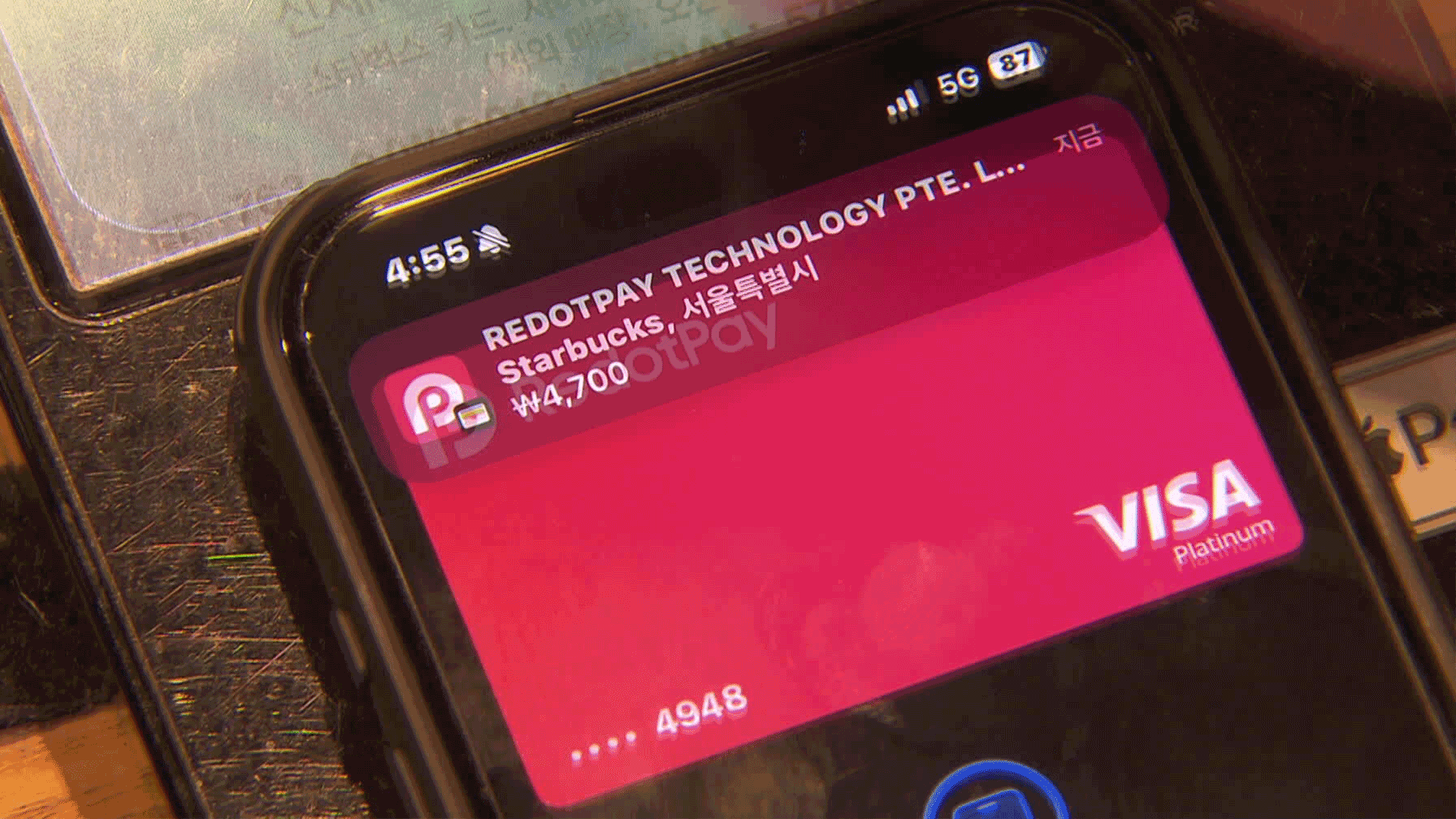

I paid for my coffee with 'Circle.'

It was processed immediately, just like a credit card.

After buying 'Circle' on a U.S. exchange, I transferred it to a virtual asset wallet and linked it with Apple Pay for payment.

This means it can be used like currency in South Korea wherever Apple Pay is accepted.

If the U.S. stablecoin basic law, known as the 'GENIUS Act,' is passed this week, the scope of use is expected to expand even further.

[Donald Trump/U.S. President/Mar. 2025: “This is a tremendous opportunity for economic growth and innovation."]

The domestic virtual asset industry is also in a race against time.

They plan to apply for the issuance of won-denominated stablecoins in the third quarter through a 'regulatory sandbox.'

[Cha Myung-hoon/CEO of virtual asset exchange 'Coinone': “I believe a new area is being created. I hope that regulations can be implemented in a fast and positive direction with a different perspective to activate this.”]

Since a decision on regulatory exemptions will be made within a maximum of 120 days, the issuance could be determined within this year.

The Bank of Korea is taking a cautious stance.

Unlike investment assets like Bitcoin, stablecoins are much closer to real money.

There are concerns that if anyone can easily issue them, it could disrupt the monetary order.

[Lee Chang-yong/Governor of the Bank of Korea/July 10: “We believe we need to be cautious and observe the impacts on the entire national economy, not just the financial industry.”]

Tether and Circle in the U.S. are issued by private companies, not banks.

The virtual asset industry argues that we need to lower regulations like the U.S. to gain a competitive edge in the market.

This is KBS News, Song Su-jin.

The abbreviation for the United States is U.S.

When you add a D, it becomes USD, which stands for dollar.

By adding one letter at a time, it becomes USDT and USDC.

These may sound unfamiliar, but they are famous virtual assets in the U.S. called 'Tether' and 'Circle.'

Recently, interest in these two coins has been heating up.

The biggest feature is 'price stability.'

1 Tether is always 1 dollar, and 1 Circle is also fixed at 1 dollar.

This is a world apart from 'Bitcoin,' the representative of virtual assets.

Today (7.14), 1 Bitcoin surpassed 120,000 dollars, setting another record high.

Compared to when it was the cheapest in the recent year, there is a 2.3 times difference.

If Bitcoin is like a stock with high volatility, Tether and Circle are like cash.

That’s why they are collectively referred to as 'stablecoins.'

Among them, the issuer of 'Circle' was listed on the U.S. stock market last month and immediately became the number one net purchase among domestic individual investors in overseas stocks.

Additionally, there is a growing movement to issue won-denominated stablecoins in South Korea.

Reporter Song Su-jin has the details.

[Report]

[“Can I help you with your order? (I would like an iced Americano.)”]

I paid for my coffee with 'Circle.'

It was processed immediately, just like a credit card.

After buying 'Circle' on a U.S. exchange, I transferred it to a virtual asset wallet and linked it with Apple Pay for payment.

This means it can be used like currency in South Korea wherever Apple Pay is accepted.

If the U.S. stablecoin basic law, known as the 'GENIUS Act,' is passed this week, the scope of use is expected to expand even further.

[Donald Trump/U.S. President/Mar. 2025: “This is a tremendous opportunity for economic growth and innovation."]

The domestic virtual asset industry is also in a race against time.

They plan to apply for the issuance of won-denominated stablecoins in the third quarter through a 'regulatory sandbox.'

[Cha Myung-hoon/CEO of virtual asset exchange 'Coinone': “I believe a new area is being created. I hope that regulations can be implemented in a fast and positive direction with a different perspective to activate this.”]

Since a decision on regulatory exemptions will be made within a maximum of 120 days, the issuance could be determined within this year.

The Bank of Korea is taking a cautious stance.

Unlike investment assets like Bitcoin, stablecoins are much closer to real money.

There are concerns that if anyone can easily issue them, it could disrupt the monetary order.

[Lee Chang-yong/Governor of the Bank of Korea/July 10: “We believe we need to be cautious and observe the impacts on the entire national economy, not just the financial industry.”]

Tether and Circle in the U.S. are issued by private companies, not banks.

The virtual asset industry argues that we need to lower regulations like the U.S. to gain a competitive edge in the market.

This is KBS News, Song Su-jin.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Stablecoins gain momentum

-

- 입력 2025-07-15 01:04:23

[Anchor]

The abbreviation for the United States is U.S.

When you add a D, it becomes USD, which stands for dollar.

By adding one letter at a time, it becomes USDT and USDC.

These may sound unfamiliar, but they are famous virtual assets in the U.S. called 'Tether' and 'Circle.'

Recently, interest in these two coins has been heating up.

The biggest feature is 'price stability.'

1 Tether is always 1 dollar, and 1 Circle is also fixed at 1 dollar.

This is a world apart from 'Bitcoin,' the representative of virtual assets.

Today (7.14), 1 Bitcoin surpassed 120,000 dollars, setting another record high.

Compared to when it was the cheapest in the recent year, there is a 2.3 times difference.

If Bitcoin is like a stock with high volatility, Tether and Circle are like cash.

That’s why they are collectively referred to as 'stablecoins.'

Among them, the issuer of 'Circle' was listed on the U.S. stock market last month and immediately became the number one net purchase among domestic individual investors in overseas stocks.

Additionally, there is a growing movement to issue won-denominated stablecoins in South Korea.

Reporter Song Su-jin has the details.

[Report]

[“Can I help you with your order? (I would like an iced Americano.)”]

I paid for my coffee with 'Circle.'

It was processed immediately, just like a credit card.

After buying 'Circle' on a U.S. exchange, I transferred it to a virtual asset wallet and linked it with Apple Pay for payment.

This means it can be used like currency in South Korea wherever Apple Pay is accepted.

If the U.S. stablecoin basic law, known as the 'GENIUS Act,' is passed this week, the scope of use is expected to expand even further.

[Donald Trump/U.S. President/Mar. 2025: “This is a tremendous opportunity for economic growth and innovation."]

The domestic virtual asset industry is also in a race against time.

They plan to apply for the issuance of won-denominated stablecoins in the third quarter through a 'regulatory sandbox.'

[Cha Myung-hoon/CEO of virtual asset exchange 'Coinone': “I believe a new area is being created. I hope that regulations can be implemented in a fast and positive direction with a different perspective to activate this.”]

Since a decision on regulatory exemptions will be made within a maximum of 120 days, the issuance could be determined within this year.

The Bank of Korea is taking a cautious stance.

Unlike investment assets like Bitcoin, stablecoins are much closer to real money.

There are concerns that if anyone can easily issue them, it could disrupt the monetary order.

[Lee Chang-yong/Governor of the Bank of Korea/July 10: “We believe we need to be cautious and observe the impacts on the entire national economy, not just the financial industry.”]

Tether and Circle in the U.S. are issued by private companies, not banks.

The virtual asset industry argues that we need to lower regulations like the U.S. to gain a competitive edge in the market.

This is KBS News, Song Su-jin.

The abbreviation for the United States is U.S.

When you add a D, it becomes USD, which stands for dollar.

By adding one letter at a time, it becomes USDT and USDC.

These may sound unfamiliar, but they are famous virtual assets in the U.S. called 'Tether' and 'Circle.'

Recently, interest in these two coins has been heating up.

The biggest feature is 'price stability.'

1 Tether is always 1 dollar, and 1 Circle is also fixed at 1 dollar.

This is a world apart from 'Bitcoin,' the representative of virtual assets.

Today (7.14), 1 Bitcoin surpassed 120,000 dollars, setting another record high.

Compared to when it was the cheapest in the recent year, there is a 2.3 times difference.

If Bitcoin is like a stock with high volatility, Tether and Circle are like cash.

That’s why they are collectively referred to as 'stablecoins.'

Among them, the issuer of 'Circle' was listed on the U.S. stock market last month and immediately became the number one net purchase among domestic individual investors in overseas stocks.

Additionally, there is a growing movement to issue won-denominated stablecoins in South Korea.

Reporter Song Su-jin has the details.

[Report]

[“Can I help you with your order? (I would like an iced Americano.)”]

I paid for my coffee with 'Circle.'

It was processed immediately, just like a credit card.

After buying 'Circle' on a U.S. exchange, I transferred it to a virtual asset wallet and linked it with Apple Pay for payment.

This means it can be used like currency in South Korea wherever Apple Pay is accepted.

If the U.S. stablecoin basic law, known as the 'GENIUS Act,' is passed this week, the scope of use is expected to expand even further.

[Donald Trump/U.S. President/Mar. 2025: “This is a tremendous opportunity for economic growth and innovation."]

The domestic virtual asset industry is also in a race against time.

They plan to apply for the issuance of won-denominated stablecoins in the third quarter through a 'regulatory sandbox.'

[Cha Myung-hoon/CEO of virtual asset exchange 'Coinone': “I believe a new area is being created. I hope that regulations can be implemented in a fast and positive direction with a different perspective to activate this.”]

Since a decision on regulatory exemptions will be made within a maximum of 120 days, the issuance could be determined within this year.

The Bank of Korea is taking a cautious stance.

Unlike investment assets like Bitcoin, stablecoins are much closer to real money.

There are concerns that if anyone can easily issue them, it could disrupt the monetary order.

[Lee Chang-yong/Governor of the Bank of Korea/July 10: “We believe we need to be cautious and observe the impacts on the entire national economy, not just the financial industry.”]

Tether and Circle in the U.S. are issued by private companies, not banks.

The virtual asset industry argues that we need to lower regulations like the U.S. to gain a competitive edge in the market.

This is KBS News, Song Su-jin.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] “윤석열·김용현 등 공모해 군사상 이익 해쳐”<br>…외환죄 대신 일반이적죄 적용](/data/layer/904/2025/07/20250714_3VTJV3.jpg)

이 기사에 대한 의견을 남겨주세요.