[Anchor]

Last week, President Lee Jae Myung warned the banking sector about being overly focused on 'interest-based profiteering' and the government has since announced follow-up measures.

The aim is to encourage banks to focus on businesses rather than households and to prioritize investment over loans. Reporter Hwang Hyun-kyu has the details.

[Report]

The GTX-A line connects Paju in Gyeonggi Province to Hwaseong.

Out of the total project cost of 3.3 trillion won, Shinhan Bank directly invested 100 billion won.

Similarly, for the GTX-C line, Kookmin Bank invested 900 billion won in the form of a fund.

These are rare cases in South Korea where banks have chosen 'investment' over 'loans.'

[President Lee Jae Myung/July 24: "I hope you will pay attention to expanding investments rather than just focusing on interest-based profiteering and interest income."]

Bank investments increase risk due to concerns about potential losses.

For example, if a bank invests 100 billion won in a company, it must evaluate that investment as 250 billion won or 400 billion won depending on whether the company goes public.

The reason banks have preferred loans over investments is due to the international standard 'Basel regulations,' which do not allow for arbitrary changes in risk weights.

However, there is an exception.

If the government also invests in the company, the bank's investment can be evaluated at the actual amount, which is the approach they plan to pursue.

[Lee Eun-jung/Professor, Department of Business Administration, Chung-Ang University: "It is true that we have been managing soundness tightly since experiencing the IMF (financial crisis). Now, we expect investments to be directed towards areas with high capital productivity."]

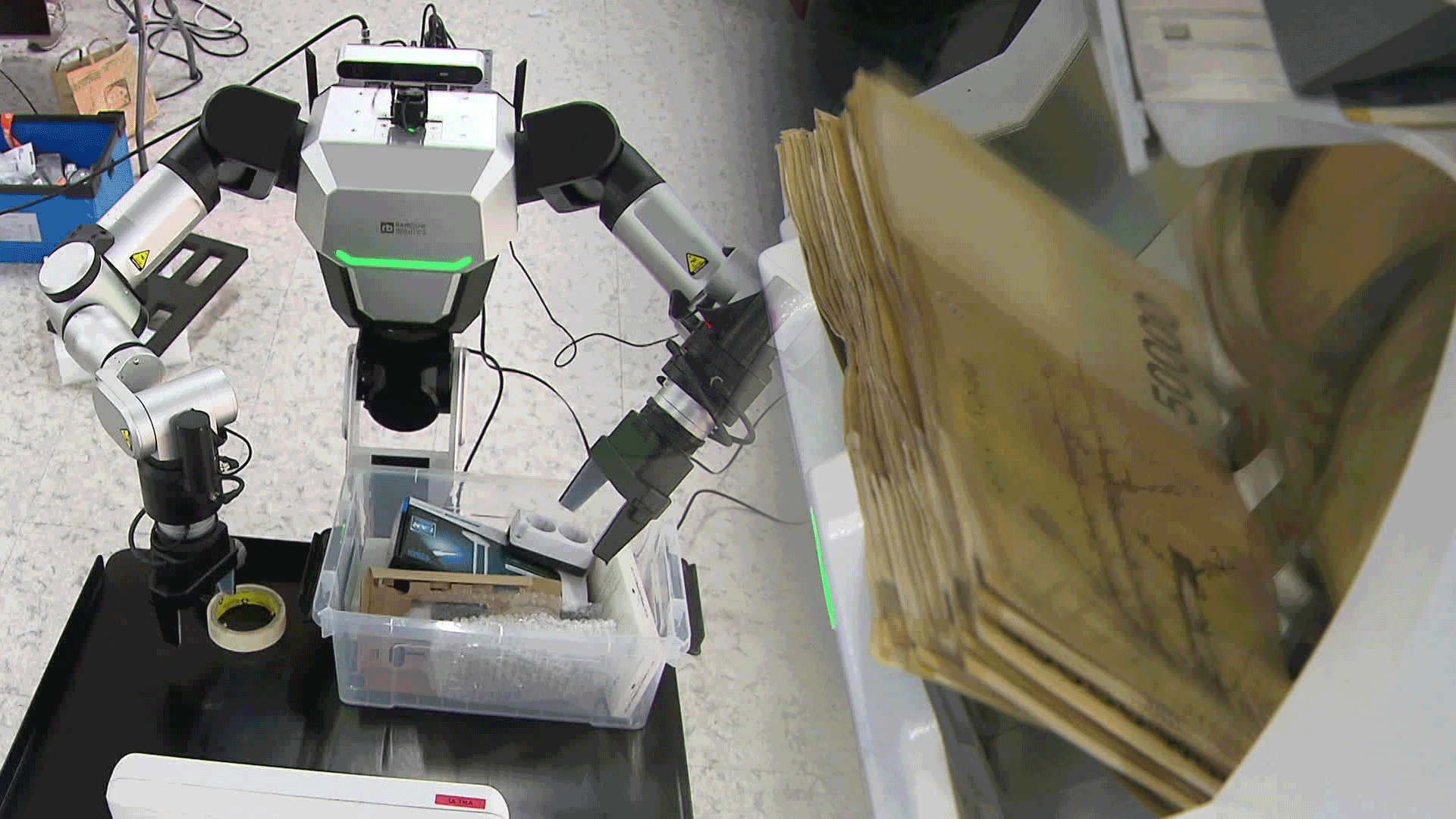

The policy background is the so-called '100 trillion fund' intended for use in artificial intelligence and robotics industries.

The government aims to increase this fund to 150 trillion won, larger than initially planned, with 50 trillion won to be covered by the Korea Development Bank, and a significant portion of the remaining 100 trillion won to be sourced from bank investments.

This is KBS News, Hwang Hyun-kyu.

Last week, President Lee Jae Myung warned the banking sector about being overly focused on 'interest-based profiteering' and the government has since announced follow-up measures.

The aim is to encourage banks to focus on businesses rather than households and to prioritize investment over loans. Reporter Hwang Hyun-kyu has the details.

[Report]

The GTX-A line connects Paju in Gyeonggi Province to Hwaseong.

Out of the total project cost of 3.3 trillion won, Shinhan Bank directly invested 100 billion won.

Similarly, for the GTX-C line, Kookmin Bank invested 900 billion won in the form of a fund.

These are rare cases in South Korea where banks have chosen 'investment' over 'loans.'

[President Lee Jae Myung/July 24: "I hope you will pay attention to expanding investments rather than just focusing on interest-based profiteering and interest income."]

Bank investments increase risk due to concerns about potential losses.

For example, if a bank invests 100 billion won in a company, it must evaluate that investment as 250 billion won or 400 billion won depending on whether the company goes public.

The reason banks have preferred loans over investments is due to the international standard 'Basel regulations,' which do not allow for arbitrary changes in risk weights.

However, there is an exception.

If the government also invests in the company, the bank's investment can be evaluated at the actual amount, which is the approach they plan to pursue.

[Lee Eun-jung/Professor, Department of Business Administration, Chung-Ang University: "It is true that we have been managing soundness tightly since experiencing the IMF (financial crisis). Now, we expect investments to be directed towards areas with high capital productivity."]

The policy background is the so-called '100 trillion fund' intended for use in artificial intelligence and robotics industries.

The government aims to increase this fund to 150 trillion won, larger than initially planned, with 50 trillion won to be covered by the Korea Development Bank, and a significant portion of the remaining 100 trillion won to be sourced from bank investments.

This is KBS News, Hwang Hyun-kyu.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Banks to invest in firms

-

- 입력 2025-07-29 02:50:46

[Anchor]

Last week, President Lee Jae Myung warned the banking sector about being overly focused on 'interest-based profiteering' and the government has since announced follow-up measures.

The aim is to encourage banks to focus on businesses rather than households and to prioritize investment over loans. Reporter Hwang Hyun-kyu has the details.

[Report]

The GTX-A line connects Paju in Gyeonggi Province to Hwaseong.

Out of the total project cost of 3.3 trillion won, Shinhan Bank directly invested 100 billion won.

Similarly, for the GTX-C line, Kookmin Bank invested 900 billion won in the form of a fund.

These are rare cases in South Korea where banks have chosen 'investment' over 'loans.'

[President Lee Jae Myung/July 24: "I hope you will pay attention to expanding investments rather than just focusing on interest-based profiteering and interest income."]

Bank investments increase risk due to concerns about potential losses.

For example, if a bank invests 100 billion won in a company, it must evaluate that investment as 250 billion won or 400 billion won depending on whether the company goes public.

The reason banks have preferred loans over investments is due to the international standard 'Basel regulations,' which do not allow for arbitrary changes in risk weights.

However, there is an exception.

If the government also invests in the company, the bank's investment can be evaluated at the actual amount, which is the approach they plan to pursue.

[Lee Eun-jung/Professor, Department of Business Administration, Chung-Ang University: "It is true that we have been managing soundness tightly since experiencing the IMF (financial crisis). Now, we expect investments to be directed towards areas with high capital productivity."]

The policy background is the so-called '100 trillion fund' intended for use in artificial intelligence and robotics industries.

The government aims to increase this fund to 150 trillion won, larger than initially planned, with 50 trillion won to be covered by the Korea Development Bank, and a significant portion of the remaining 100 trillion won to be sourced from bank investments.

This is KBS News, Hwang Hyun-kyu.

Last week, President Lee Jae Myung warned the banking sector about being overly focused on 'interest-based profiteering' and the government has since announced follow-up measures.

The aim is to encourage banks to focus on businesses rather than households and to prioritize investment over loans. Reporter Hwang Hyun-kyu has the details.

[Report]

The GTX-A line connects Paju in Gyeonggi Province to Hwaseong.

Out of the total project cost of 3.3 trillion won, Shinhan Bank directly invested 100 billion won.

Similarly, for the GTX-C line, Kookmin Bank invested 900 billion won in the form of a fund.

These are rare cases in South Korea where banks have chosen 'investment' over 'loans.'

[President Lee Jae Myung/July 24: "I hope you will pay attention to expanding investments rather than just focusing on interest-based profiteering and interest income."]

Bank investments increase risk due to concerns about potential losses.

For example, if a bank invests 100 billion won in a company, it must evaluate that investment as 250 billion won or 400 billion won depending on whether the company goes public.

The reason banks have preferred loans over investments is due to the international standard 'Basel regulations,' which do not allow for arbitrary changes in risk weights.

However, there is an exception.

If the government also invests in the company, the bank's investment can be evaluated at the actual amount, which is the approach they plan to pursue.

[Lee Eun-jung/Professor, Department of Business Administration, Chung-Ang University: "It is true that we have been managing soundness tightly since experiencing the IMF (financial crisis). Now, we expect investments to be directed towards areas with high capital productivity."]

The policy background is the so-called '100 trillion fund' intended for use in artificial intelligence and robotics industries.

The government aims to increase this fund to 150 trillion won, larger than initially planned, with 50 trillion won to be covered by the Korea Development Bank, and a significant portion of the remaining 100 trillion won to be sourced from bank investments.

This is KBS News, Hwang Hyun-kyu.

-

-

황현규 기자 help@kbs.co.kr

황현규 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.