[Anchor]

As unsold homes and vacant houses increase in rural areas, the government has decided to expand the 'second home benefit'.

Even if you already own a home, when purchasing a house in small cities in rural areas, you will be considered a 'one-home owner'.

Reporter Hwang Hyun-kyu will tell us what tax benefits can be received in which regions.

[Report]

This is a model house that was opened for sale earlier this month in Jeonju, North Jeolla Province.

Although the real estate market in rural areas has cooled, there were still quite a few applicants for the sale.

There is demand for new homes even in rural areas.

[Kang Bok-hyun/Head of Sales Agency/Last Month: "Since it's a new sale after 8 years, we believe there will be sufficient demand."]

The government is expanding the 'second home' benefits.

The target areas have been expanded to include not only existing population decline areas but also areas of 'interest' in population decline.

Nine regional hub cities, including Gangneung, Sokcho, Iksan, Gyeongju, and Tongyeong, have been included.

If you purchase a second home in these areas with a publicly announced price of 400 million won or less, you will be treated as a 'one-home owner' for all real estate taxes, including capital gains tax, comprehensive real estate tax, property tax, and acquisition tax.

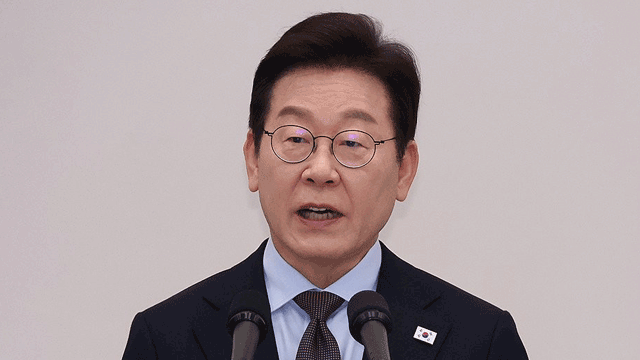

[Koo Yoon-cheol/Vice Minister of Economy: "The ability to grow is declining as funds are not circulating in the regions, which are the roots of the economy."]

This is essentially paving the way for the increasing number of medium- to long-term residents, such as those participating in 'one-month living' and '5 provinces, 2 villages', to purchase a second home, but the effectiveness is in question.

[Choi Hwang-soo/Professor at Konkuk University Graduate School of Real Estate: "Even if they are doing 'one-month living', I think the intention to rent might be stronger."]

The government is also increasing tax benefits for those who buy unsold homes in rural areas and rent them out.

By temporarily reviving the '10-year private rental for purchased apartments' for one year, private rental businesses will be exempt from the capital gains tax increase.

However, this benefit only applies to areas experiencing population decline.

The government aims to implement measures that do not require legal amendments as early as the second half of this year, and those that require legal amendments in the first half of next year.

This is KBS News Hwang Hyun-kyu.

As unsold homes and vacant houses increase in rural areas, the government has decided to expand the 'second home benefit'.

Even if you already own a home, when purchasing a house in small cities in rural areas, you will be considered a 'one-home owner'.

Reporter Hwang Hyun-kyu will tell us what tax benefits can be received in which regions.

[Report]

This is a model house that was opened for sale earlier this month in Jeonju, North Jeolla Province.

Although the real estate market in rural areas has cooled, there were still quite a few applicants for the sale.

There is demand for new homes even in rural areas.

[Kang Bok-hyun/Head of Sales Agency/Last Month: "Since it's a new sale after 8 years, we believe there will be sufficient demand."]

The government is expanding the 'second home' benefits.

The target areas have been expanded to include not only existing population decline areas but also areas of 'interest' in population decline.

Nine regional hub cities, including Gangneung, Sokcho, Iksan, Gyeongju, and Tongyeong, have been included.

If you purchase a second home in these areas with a publicly announced price of 400 million won or less, you will be treated as a 'one-home owner' for all real estate taxes, including capital gains tax, comprehensive real estate tax, property tax, and acquisition tax.

[Koo Yoon-cheol/Vice Minister of Economy: "The ability to grow is declining as funds are not circulating in the regions, which are the roots of the economy."]

This is essentially paving the way for the increasing number of medium- to long-term residents, such as those participating in 'one-month living' and '5 provinces, 2 villages', to purchase a second home, but the effectiveness is in question.

[Choi Hwang-soo/Professor at Konkuk University Graduate School of Real Estate: "Even if they are doing 'one-month living', I think the intention to rent might be stronger."]

The government is also increasing tax benefits for those who buy unsold homes in rural areas and rent them out.

By temporarily reviving the '10-year private rental for purchased apartments' for one year, private rental businesses will be exempt from the capital gains tax increase.

However, this benefit only applies to areas experiencing population decline.

The government aims to implement measures that do not require legal amendments as early as the second half of this year, and those that require legal amendments in the first half of next year.

This is KBS News Hwang Hyun-kyu.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Second home benefit to expand

-

- 입력 2025-08-15 00:49:46

[Anchor]

As unsold homes and vacant houses increase in rural areas, the government has decided to expand the 'second home benefit'.

Even if you already own a home, when purchasing a house in small cities in rural areas, you will be considered a 'one-home owner'.

Reporter Hwang Hyun-kyu will tell us what tax benefits can be received in which regions.

[Report]

This is a model house that was opened for sale earlier this month in Jeonju, North Jeolla Province.

Although the real estate market in rural areas has cooled, there were still quite a few applicants for the sale.

There is demand for new homes even in rural areas.

[Kang Bok-hyun/Head of Sales Agency/Last Month: "Since it's a new sale after 8 years, we believe there will be sufficient demand."]

The government is expanding the 'second home' benefits.

The target areas have been expanded to include not only existing population decline areas but also areas of 'interest' in population decline.

Nine regional hub cities, including Gangneung, Sokcho, Iksan, Gyeongju, and Tongyeong, have been included.

If you purchase a second home in these areas with a publicly announced price of 400 million won or less, you will be treated as a 'one-home owner' for all real estate taxes, including capital gains tax, comprehensive real estate tax, property tax, and acquisition tax.

[Koo Yoon-cheol/Vice Minister of Economy: "The ability to grow is declining as funds are not circulating in the regions, which are the roots of the economy."]

This is essentially paving the way for the increasing number of medium- to long-term residents, such as those participating in 'one-month living' and '5 provinces, 2 villages', to purchase a second home, but the effectiveness is in question.

[Choi Hwang-soo/Professor at Konkuk University Graduate School of Real Estate: "Even if they are doing 'one-month living', I think the intention to rent might be stronger."]

The government is also increasing tax benefits for those who buy unsold homes in rural areas and rent them out.

By temporarily reviving the '10-year private rental for purchased apartments' for one year, private rental businesses will be exempt from the capital gains tax increase.

However, this benefit only applies to areas experiencing population decline.

The government aims to implement measures that do not require legal amendments as early as the second half of this year, and those that require legal amendments in the first half of next year.

This is KBS News Hwang Hyun-kyu.

As unsold homes and vacant houses increase in rural areas, the government has decided to expand the 'second home benefit'.

Even if you already own a home, when purchasing a house in small cities in rural areas, you will be considered a 'one-home owner'.

Reporter Hwang Hyun-kyu will tell us what tax benefits can be received in which regions.

[Report]

This is a model house that was opened for sale earlier this month in Jeonju, North Jeolla Province.

Although the real estate market in rural areas has cooled, there were still quite a few applicants for the sale.

There is demand for new homes even in rural areas.

[Kang Bok-hyun/Head of Sales Agency/Last Month: "Since it's a new sale after 8 years, we believe there will be sufficient demand."]

The government is expanding the 'second home' benefits.

The target areas have been expanded to include not only existing population decline areas but also areas of 'interest' in population decline.

Nine regional hub cities, including Gangneung, Sokcho, Iksan, Gyeongju, and Tongyeong, have been included.

If you purchase a second home in these areas with a publicly announced price of 400 million won or less, you will be treated as a 'one-home owner' for all real estate taxes, including capital gains tax, comprehensive real estate tax, property tax, and acquisition tax.

[Koo Yoon-cheol/Vice Minister of Economy: "The ability to grow is declining as funds are not circulating in the regions, which are the roots of the economy."]

This is essentially paving the way for the increasing number of medium- to long-term residents, such as those participating in 'one-month living' and '5 provinces, 2 villages', to purchase a second home, but the effectiveness is in question.

[Choi Hwang-soo/Professor at Konkuk University Graduate School of Real Estate: "Even if they are doing 'one-month living', I think the intention to rent might be stronger."]

The government is also increasing tax benefits for those who buy unsold homes in rural areas and rent them out.

By temporarily reviving the '10-year private rental for purchased apartments' for one year, private rental businesses will be exempt from the capital gains tax increase.

However, this benefit only applies to areas experiencing population decline.

The government aims to implement measures that do not require legal amendments as early as the second half of this year, and those that require legal amendments in the first half of next year.

This is KBS News Hwang Hyun-kyu.

-

-

황현규 기자 help@kbs.co.kr

황현규 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.