[Anchor]

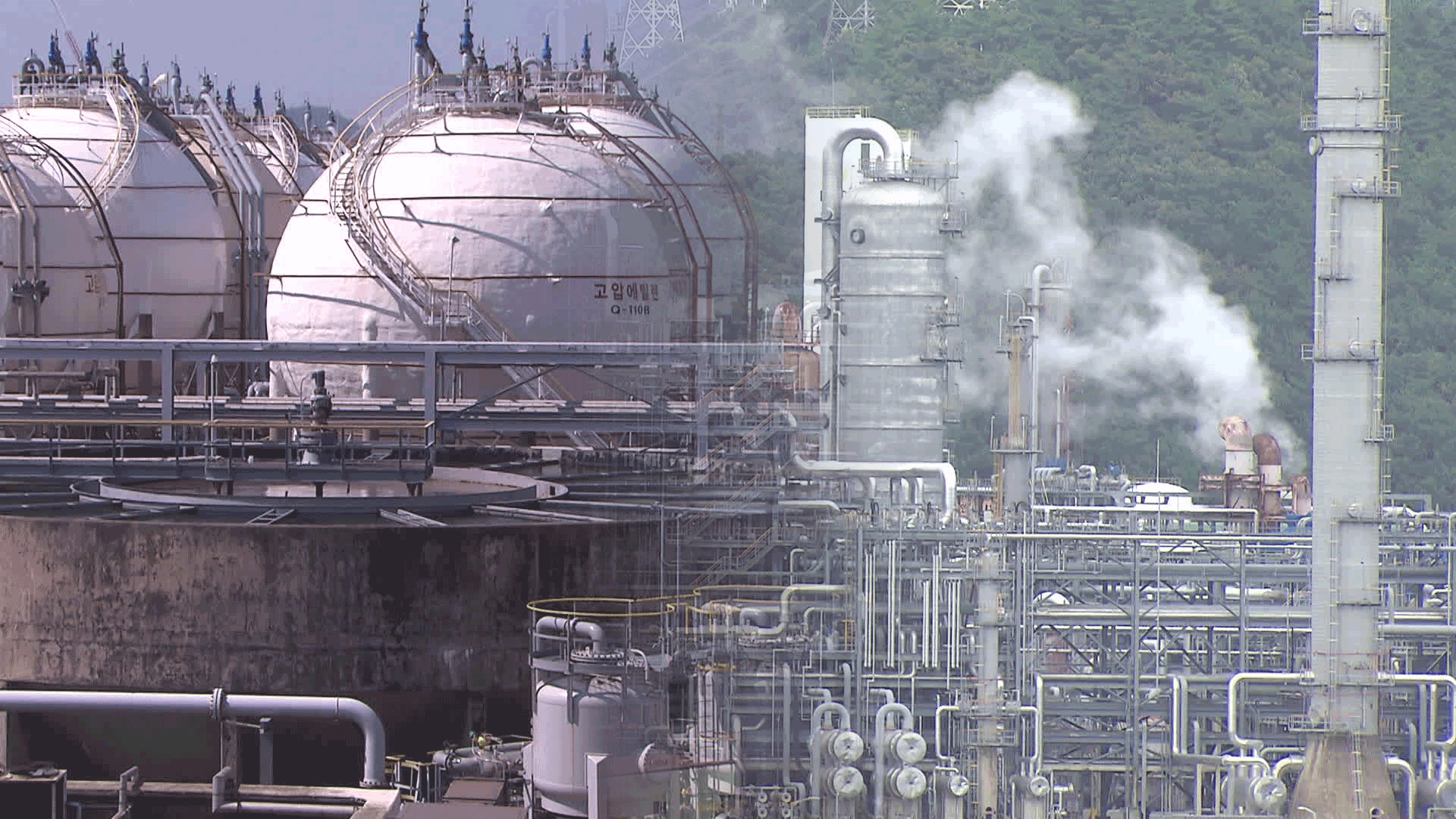

The Yeocheon NCC in Yeosu has recently halted production lines at its third plant.

Our core export-driving industry is now shaking at its roots in the petrochemical sector.

Among the three major petrochemical industrial complexes, Yeosu and Ulsan complexes have been suspended more than a dozen production lines.

In the Daesan industrial complex, major companies are discussing mergers and consolidations.

The low-price offensive from Chinese products is cited as a major cause.

In the case of ethylene, a basic raw material for petrochemicals, China's production capacity has increased by over 60% in four years, impacting our industry.

There are analyses suggesting that half of the companies could disappear within three years if this continues.

Ultimately, the government has initiated a restructuring of the petrochemical industry.

Reporter Jeong Jae-woo has the details.

[Report]

The government sees the biggest problem in the petrochemical industry as excessive supply compared to demand.

[Koo Yoon-cheol/Deputy Prime Minister for Economy: "In the past, we were intoxicated by prosperity and instead expanded facilities, and we are now facing significant difficulties due to failing to transition to high value-added products."]

First, they demanded that companies downsize.

The scale of ethylene production facility reductions proposed by the industry is up to 3.7 million tons, which is about 25% of the total domestic petrochemical facilities and exceeds the scale of the industry leader LG Chem.

While emphasizing that voluntary business restructuring is fundamental, the government warned that companies delaying implementation while being cautious will be excluded from support.

[Kim Jung-kwan/Minister of Trade, Industry and Energy: "We will respond firmly to companies that are free-riding. Companies that try to survive on government support without self-rescue efforts or only benefit from the facility reduction of other companies..."]

The petrochemical industry has been in the red for four consecutive years since 2022.

The operating rate of ethylene production facilities has dropped from 89.2% five years ago to around 80%.

If they downsize as planned, they expect to secure an appropriate operating rate of 85%, which will ensure profitability.

The industry is also planning to shift from general-purpose products, where competition with China is fierce, to high value-added products, but government support is needed for this as well.

[Jo Yong-won/Research Fellow at the Korea Institute for Industrial Economics and Trade: "It's difficult because advanced countries have already occupied the market and we have to find a way in. For demand to be guaranteed, the government needs to be involved."]

Considering the local economy, the government is reviewing plans to designate Seosan as an early crisis response area following Yeosu, where the industrial complex is located, to provide support funds and loan benefits.

This is KBS News, Jeong Jae-woo.

The Yeocheon NCC in Yeosu has recently halted production lines at its third plant.

Our core export-driving industry is now shaking at its roots in the petrochemical sector.

Among the three major petrochemical industrial complexes, Yeosu and Ulsan complexes have been suspended more than a dozen production lines.

In the Daesan industrial complex, major companies are discussing mergers and consolidations.

The low-price offensive from Chinese products is cited as a major cause.

In the case of ethylene, a basic raw material for petrochemicals, China's production capacity has increased by over 60% in four years, impacting our industry.

There are analyses suggesting that half of the companies could disappear within three years if this continues.

Ultimately, the government has initiated a restructuring of the petrochemical industry.

Reporter Jeong Jae-woo has the details.

[Report]

The government sees the biggest problem in the petrochemical industry as excessive supply compared to demand.

[Koo Yoon-cheol/Deputy Prime Minister for Economy: "In the past, we were intoxicated by prosperity and instead expanded facilities, and we are now facing significant difficulties due to failing to transition to high value-added products."]

First, they demanded that companies downsize.

The scale of ethylene production facility reductions proposed by the industry is up to 3.7 million tons, which is about 25% of the total domestic petrochemical facilities and exceeds the scale of the industry leader LG Chem.

While emphasizing that voluntary business restructuring is fundamental, the government warned that companies delaying implementation while being cautious will be excluded from support.

[Kim Jung-kwan/Minister of Trade, Industry and Energy: "We will respond firmly to companies that are free-riding. Companies that try to survive on government support without self-rescue efforts or only benefit from the facility reduction of other companies..."]

The petrochemical industry has been in the red for four consecutive years since 2022.

The operating rate of ethylene production facilities has dropped from 89.2% five years ago to around 80%.

If they downsize as planned, they expect to secure an appropriate operating rate of 85%, which will ensure profitability.

The industry is also planning to shift from general-purpose products, where competition with China is fierce, to high value-added products, but government support is needed for this as well.

[Jo Yong-won/Research Fellow at the Korea Institute for Industrial Economics and Trade: "It's difficult because advanced countries have already occupied the market and we have to find a way in. For demand to be guaranteed, the government needs to be involved."]

Considering the local economy, the government is reviewing plans to designate Seosan as an early crisis response area following Yeosu, where the industrial complex is located, to provide support funds and loan benefits.

This is KBS News, Jeong Jae-woo.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Gov’t launches petrochem overhaul

-

- 입력 2025-08-21 15:12:47

[Anchor]

The Yeocheon NCC in Yeosu has recently halted production lines at its third plant.

Our core export-driving industry is now shaking at its roots in the petrochemical sector.

Among the three major petrochemical industrial complexes, Yeosu and Ulsan complexes have been suspended more than a dozen production lines.

In the Daesan industrial complex, major companies are discussing mergers and consolidations.

The low-price offensive from Chinese products is cited as a major cause.

In the case of ethylene, a basic raw material for petrochemicals, China's production capacity has increased by over 60% in four years, impacting our industry.

There are analyses suggesting that half of the companies could disappear within three years if this continues.

Ultimately, the government has initiated a restructuring of the petrochemical industry.

Reporter Jeong Jae-woo has the details.

[Report]

The government sees the biggest problem in the petrochemical industry as excessive supply compared to demand.

[Koo Yoon-cheol/Deputy Prime Minister for Economy: "In the past, we were intoxicated by prosperity and instead expanded facilities, and we are now facing significant difficulties due to failing to transition to high value-added products."]

First, they demanded that companies downsize.

The scale of ethylene production facility reductions proposed by the industry is up to 3.7 million tons, which is about 25% of the total domestic petrochemical facilities and exceeds the scale of the industry leader LG Chem.

While emphasizing that voluntary business restructuring is fundamental, the government warned that companies delaying implementation while being cautious will be excluded from support.

[Kim Jung-kwan/Minister of Trade, Industry and Energy: "We will respond firmly to companies that are free-riding. Companies that try to survive on government support without self-rescue efforts or only benefit from the facility reduction of other companies..."]

The petrochemical industry has been in the red for four consecutive years since 2022.

The operating rate of ethylene production facilities has dropped from 89.2% five years ago to around 80%.

If they downsize as planned, they expect to secure an appropriate operating rate of 85%, which will ensure profitability.

The industry is also planning to shift from general-purpose products, where competition with China is fierce, to high value-added products, but government support is needed for this as well.

[Jo Yong-won/Research Fellow at the Korea Institute for Industrial Economics and Trade: "It's difficult because advanced countries have already occupied the market and we have to find a way in. For demand to be guaranteed, the government needs to be involved."]

Considering the local economy, the government is reviewing plans to designate Seosan as an early crisis response area following Yeosu, where the industrial complex is located, to provide support funds and loan benefits.

This is KBS News, Jeong Jae-woo.

The Yeocheon NCC in Yeosu has recently halted production lines at its third plant.

Our core export-driving industry is now shaking at its roots in the petrochemical sector.

Among the three major petrochemical industrial complexes, Yeosu and Ulsan complexes have been suspended more than a dozen production lines.

In the Daesan industrial complex, major companies are discussing mergers and consolidations.

The low-price offensive from Chinese products is cited as a major cause.

In the case of ethylene, a basic raw material for petrochemicals, China's production capacity has increased by over 60% in four years, impacting our industry.

There are analyses suggesting that half of the companies could disappear within three years if this continues.

Ultimately, the government has initiated a restructuring of the petrochemical industry.

Reporter Jeong Jae-woo has the details.

[Report]

The government sees the biggest problem in the petrochemical industry as excessive supply compared to demand.

[Koo Yoon-cheol/Deputy Prime Minister for Economy: "In the past, we were intoxicated by prosperity and instead expanded facilities, and we are now facing significant difficulties due to failing to transition to high value-added products."]

First, they demanded that companies downsize.

The scale of ethylene production facility reductions proposed by the industry is up to 3.7 million tons, which is about 25% of the total domestic petrochemical facilities and exceeds the scale of the industry leader LG Chem.

While emphasizing that voluntary business restructuring is fundamental, the government warned that companies delaying implementation while being cautious will be excluded from support.

[Kim Jung-kwan/Minister of Trade, Industry and Energy: "We will respond firmly to companies that are free-riding. Companies that try to survive on government support without self-rescue efforts or only benefit from the facility reduction of other companies..."]

The petrochemical industry has been in the red for four consecutive years since 2022.

The operating rate of ethylene production facilities has dropped from 89.2% five years ago to around 80%.

If they downsize as planned, they expect to secure an appropriate operating rate of 85%, which will ensure profitability.

The industry is also planning to shift from general-purpose products, where competition with China is fierce, to high value-added products, but government support is needed for this as well.

[Jo Yong-won/Research Fellow at the Korea Institute for Industrial Economics and Trade: "It's difficult because advanced countries have already occupied the market and we have to find a way in. For demand to be guaranteed, the government needs to be involved."]

Considering the local economy, the government is reviewing plans to designate Seosan as an early crisis response area following Yeosu, where the industrial complex is located, to provide support funds and loan benefits.

This is KBS News, Jeong Jae-woo.

-

-

정재우 기자 jjw@kbs.co.kr

정재우 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.