U.S. prompts equity-subsidy tradeoff

입력 2025.08.21 (16:08)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

Reports have emerged that the U.S. government will not stop at securing stakes in this manner at Intel.

Samsung Electronics is immediately affected by this.

If implemented, semiconductor companies are in a perplexing situation, having to choose whether to give up their stakes or forgo subsidies.

Next, we have Lee Do-yoon with the report.

[Report]

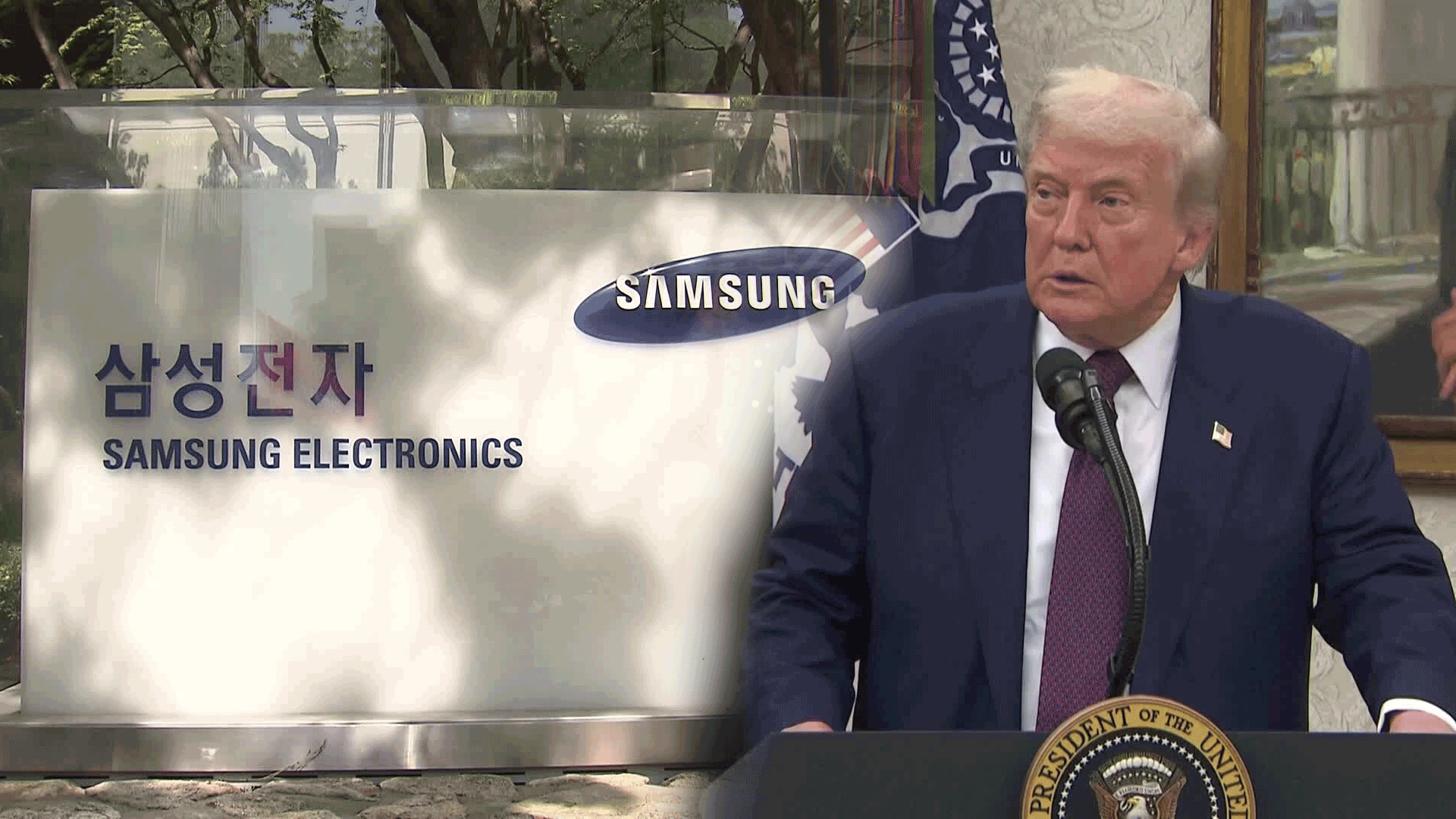

This is a Samsung Electronics semiconductor factory under construction in Texas, USA.

[Greg Abbott/Former Governor of Texas/November 2021: "Thank you again, Samsung, for such a large investment."]

The construction cost alone amounts to 24 trillion won.

Samsung has decided to invest 53 trillion won in the U.S. by 2030, and in return, the U.S. has promised a subsidy of 4.7 billion dollars, equivalent to 6.6 trillion won.

However, it has been reported that the Trump administration is considering a plan to convert subsidies for foreign companies into equity stakes.

If we assume that, like Intel, the subsidy represents a portion of the market capitalization and is received in equity, the stake that the U.S. could obtain from Samsung Electronics would be 1.58%.

This is nearly equivalent to the stake held by Chairman Lee Jae-yong.

Companies are now faced with the choice of whether to give up their stakes or forgo subsidies.

[Kim Yang-pang/Specialist Researcher at the Korea Institute for Industrial Economics & Trade: "For our companies, there would be no need to receive subsidies at the cost of giving up equity. The money that was prepared as subsidies would go to U.S. companies and not come to our companies."]

When the U.S. government approved the acquisition of U.S. Steel by Japan, it demanded a so-called 'golden share' that would influence major management decisions of the company.

National security was cited as the justification, and the same approach could be applied to semiconductor companies.

[Jang Sang-sik/Director of Trade and Economic Research at the Korea International Trade Association: "This is very different from the existing principles of a free market. It can be seen as a new industrial policy where the government directly intervenes in the private sector, similar to China's state capitalism model, citing national security and technological hegemony."]

However, if the effect of subsidies disappears, semiconductor prices in the U.S. will also rise, so the implementation of this plan remains to be watched.

President Trump has already warned of imposing tariffs of up to 300% on semiconductor companies that do not invest domestically.

This is Lee Do-yoon from KBS News.

Reports have emerged that the U.S. government will not stop at securing stakes in this manner at Intel.

Samsung Electronics is immediately affected by this.

If implemented, semiconductor companies are in a perplexing situation, having to choose whether to give up their stakes or forgo subsidies.

Next, we have Lee Do-yoon with the report.

[Report]

This is a Samsung Electronics semiconductor factory under construction in Texas, USA.

[Greg Abbott/Former Governor of Texas/November 2021: "Thank you again, Samsung, for such a large investment."]

The construction cost alone amounts to 24 trillion won.

Samsung has decided to invest 53 trillion won in the U.S. by 2030, and in return, the U.S. has promised a subsidy of 4.7 billion dollars, equivalent to 6.6 trillion won.

However, it has been reported that the Trump administration is considering a plan to convert subsidies for foreign companies into equity stakes.

If we assume that, like Intel, the subsidy represents a portion of the market capitalization and is received in equity, the stake that the U.S. could obtain from Samsung Electronics would be 1.58%.

This is nearly equivalent to the stake held by Chairman Lee Jae-yong.

Companies are now faced with the choice of whether to give up their stakes or forgo subsidies.

[Kim Yang-pang/Specialist Researcher at the Korea Institute for Industrial Economics & Trade: "For our companies, there would be no need to receive subsidies at the cost of giving up equity. The money that was prepared as subsidies would go to U.S. companies and not come to our companies."]

When the U.S. government approved the acquisition of U.S. Steel by Japan, it demanded a so-called 'golden share' that would influence major management decisions of the company.

National security was cited as the justification, and the same approach could be applied to semiconductor companies.

[Jang Sang-sik/Director of Trade and Economic Research at the Korea International Trade Association: "This is very different from the existing principles of a free market. It can be seen as a new industrial policy where the government directly intervenes in the private sector, similar to China's state capitalism model, citing national security and technological hegemony."]

However, if the effect of subsidies disappears, semiconductor prices in the U.S. will also rise, so the implementation of this plan remains to be watched.

President Trump has already warned of imposing tariffs of up to 300% on semiconductor companies that do not invest domestically.

This is Lee Do-yoon from KBS News.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- U.S. prompts equity-subsidy tradeoff

-

- 입력 2025-08-21 16:08:21

[Anchor]

Reports have emerged that the U.S. government will not stop at securing stakes in this manner at Intel.

Samsung Electronics is immediately affected by this.

If implemented, semiconductor companies are in a perplexing situation, having to choose whether to give up their stakes or forgo subsidies.

Next, we have Lee Do-yoon with the report.

[Report]

This is a Samsung Electronics semiconductor factory under construction in Texas, USA.

[Greg Abbott/Former Governor of Texas/November 2021: "Thank you again, Samsung, for such a large investment."]

The construction cost alone amounts to 24 trillion won.

Samsung has decided to invest 53 trillion won in the U.S. by 2030, and in return, the U.S. has promised a subsidy of 4.7 billion dollars, equivalent to 6.6 trillion won.

However, it has been reported that the Trump administration is considering a plan to convert subsidies for foreign companies into equity stakes.

If we assume that, like Intel, the subsidy represents a portion of the market capitalization and is received in equity, the stake that the U.S. could obtain from Samsung Electronics would be 1.58%.

This is nearly equivalent to the stake held by Chairman Lee Jae-yong.

Companies are now faced with the choice of whether to give up their stakes or forgo subsidies.

[Kim Yang-pang/Specialist Researcher at the Korea Institute for Industrial Economics & Trade: "For our companies, there would be no need to receive subsidies at the cost of giving up equity. The money that was prepared as subsidies would go to U.S. companies and not come to our companies."]

When the U.S. government approved the acquisition of U.S. Steel by Japan, it demanded a so-called 'golden share' that would influence major management decisions of the company.

National security was cited as the justification, and the same approach could be applied to semiconductor companies.

[Jang Sang-sik/Director of Trade and Economic Research at the Korea International Trade Association: "This is very different from the existing principles of a free market. It can be seen as a new industrial policy where the government directly intervenes in the private sector, similar to China's state capitalism model, citing national security and technological hegemony."]

However, if the effect of subsidies disappears, semiconductor prices in the U.S. will also rise, so the implementation of this plan remains to be watched.

President Trump has already warned of imposing tariffs of up to 300% on semiconductor companies that do not invest domestically.

This is Lee Do-yoon from KBS News.

Reports have emerged that the U.S. government will not stop at securing stakes in this manner at Intel.

Samsung Electronics is immediately affected by this.

If implemented, semiconductor companies are in a perplexing situation, having to choose whether to give up their stakes or forgo subsidies.

Next, we have Lee Do-yoon with the report.

[Report]

This is a Samsung Electronics semiconductor factory under construction in Texas, USA.

[Greg Abbott/Former Governor of Texas/November 2021: "Thank you again, Samsung, for such a large investment."]

The construction cost alone amounts to 24 trillion won.

Samsung has decided to invest 53 trillion won in the U.S. by 2030, and in return, the U.S. has promised a subsidy of 4.7 billion dollars, equivalent to 6.6 trillion won.

However, it has been reported that the Trump administration is considering a plan to convert subsidies for foreign companies into equity stakes.

If we assume that, like Intel, the subsidy represents a portion of the market capitalization and is received in equity, the stake that the U.S. could obtain from Samsung Electronics would be 1.58%.

This is nearly equivalent to the stake held by Chairman Lee Jae-yong.

Companies are now faced with the choice of whether to give up their stakes or forgo subsidies.

[Kim Yang-pang/Specialist Researcher at the Korea Institute for Industrial Economics & Trade: "For our companies, there would be no need to receive subsidies at the cost of giving up equity. The money that was prepared as subsidies would go to U.S. companies and not come to our companies."]

When the U.S. government approved the acquisition of U.S. Steel by Japan, it demanded a so-called 'golden share' that would influence major management decisions of the company.

National security was cited as the justification, and the same approach could be applied to semiconductor companies.

[Jang Sang-sik/Director of Trade and Economic Research at the Korea International Trade Association: "This is very different from the existing principles of a free market. It can be seen as a new industrial policy where the government directly intervenes in the private sector, similar to China's state capitalism model, citing national security and technological hegemony."]

However, if the effect of subsidies disappears, semiconductor prices in the U.S. will also rise, so the implementation of this plan remains to be watched.

President Trump has already warned of imposing tariffs of up to 300% on semiconductor companies that do not invest domestically.

This is Lee Do-yoon from KBS News.

-

-

이도윤 기자 dobby@kbs.co.kr

이도윤 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.