[Anchor]

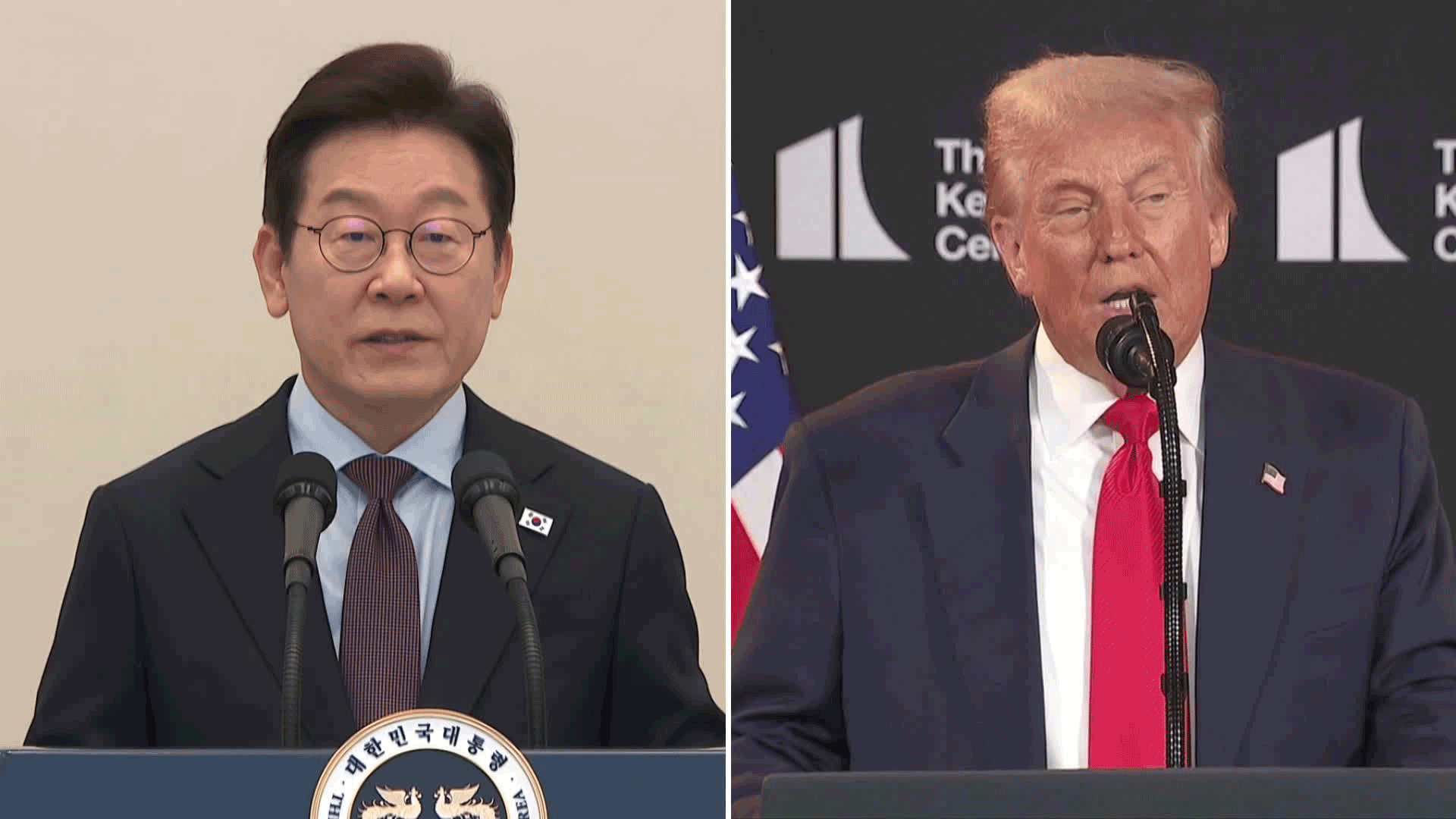

The reason behind our attention to this Korea-U.S. summit is the tariff shock from the United States.

Although tariff negotiations have concluded, the steel industry, which is already facing a high tariff of 50%, and the automobile industry, which is still subject to a 25% tariff, are in a state of emergency regarding exports to the U.S.

Reporter Choi In-young has the details.

[Report]

In March, the U.S. imposed a 25% tariff on imported steel, and in June, it raised the tariff to 50%.

Just one month after the 50% tariff was implemented, our steel exports to the U.S. dropped by nearly 26% compared to the same period last year.

This marks the lowest level in over four years in terms of export value and the lowest in over two years in terms of volume.

[Jang Sang-sik/Director of Trade and Economic Research Institute, Korea International Trade Association: "Considering that there is a one to two-month lag between steel export contracts and shipments, the increase in tariffs and the decrease in imports by the U.S. are directly reflected..."]

Since the 18th, the U.S. has additionally applied a 50% tariff on 407 items, including transformers and home appliances made with steel and aluminum materials, further increasing the burden.

Since April, automobiles have been subject to a 25% tariff, and exports to the U.S. have consistently been on the decline.

Electric vehicles, in particular, are suffering significant impacts.

Last month, only 164 electric vehicles were exported to the U.S., a drastic decrease of 97.4% compared to the same month last year. Even when looking at the period up to July this year, there was an 88.4% drop.

This is believed to be due to the reduction of tax credit benefits for electric vehicle purchases in the U.S., as well as Hyundai and Kia increasing local production to respond to tariffs.

[Joo Won/Director of Economic Research, Hyundai Economic Research Institute: "As the market itself shrinks, the existing demand will likely concentrate on vehicles like Tesla that are not affected by tariffs..."]

Starting next month, as the U.S. electric vehicle tax credit is set to end early, performance may worsen further.

This is KBS News, Choi In-young.

The reason behind our attention to this Korea-U.S. summit is the tariff shock from the United States.

Although tariff negotiations have concluded, the steel industry, which is already facing a high tariff of 50%, and the automobile industry, which is still subject to a 25% tariff, are in a state of emergency regarding exports to the U.S.

Reporter Choi In-young has the details.

[Report]

In March, the U.S. imposed a 25% tariff on imported steel, and in June, it raised the tariff to 50%.

Just one month after the 50% tariff was implemented, our steel exports to the U.S. dropped by nearly 26% compared to the same period last year.

This marks the lowest level in over four years in terms of export value and the lowest in over two years in terms of volume.

[Jang Sang-sik/Director of Trade and Economic Research Institute, Korea International Trade Association: "Considering that there is a one to two-month lag between steel export contracts and shipments, the increase in tariffs and the decrease in imports by the U.S. are directly reflected..."]

Since the 18th, the U.S. has additionally applied a 50% tariff on 407 items, including transformers and home appliances made with steel and aluminum materials, further increasing the burden.

Since April, automobiles have been subject to a 25% tariff, and exports to the U.S. have consistently been on the decline.

Electric vehicles, in particular, are suffering significant impacts.

Last month, only 164 electric vehicles were exported to the U.S., a drastic decrease of 97.4% compared to the same month last year. Even when looking at the period up to July this year, there was an 88.4% drop.

This is believed to be due to the reduction of tax credit benefits for electric vehicle purchases in the U.S., as well as Hyundai and Kia increasing local production to respond to tariffs.

[Joo Won/Director of Economic Research, Hyundai Economic Research Institute: "As the market itself shrinks, the existing demand will likely concentrate on vehicles like Tesla that are not affected by tariffs..."]

Starting next month, as the U.S. electric vehicle tax credit is set to end early, performance may worsen further.

This is KBS News, Choi In-young.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Summit to address U.S. tariffs

-

- 입력 2025-08-25 01:54:36

[Anchor]

The reason behind our attention to this Korea-U.S. summit is the tariff shock from the United States.

Although tariff negotiations have concluded, the steel industry, which is already facing a high tariff of 50%, and the automobile industry, which is still subject to a 25% tariff, are in a state of emergency regarding exports to the U.S.

Reporter Choi In-young has the details.

[Report]

In March, the U.S. imposed a 25% tariff on imported steel, and in June, it raised the tariff to 50%.

Just one month after the 50% tariff was implemented, our steel exports to the U.S. dropped by nearly 26% compared to the same period last year.

This marks the lowest level in over four years in terms of export value and the lowest in over two years in terms of volume.

[Jang Sang-sik/Director of Trade and Economic Research Institute, Korea International Trade Association: "Considering that there is a one to two-month lag between steel export contracts and shipments, the increase in tariffs and the decrease in imports by the U.S. are directly reflected..."]

Since the 18th, the U.S. has additionally applied a 50% tariff on 407 items, including transformers and home appliances made with steel and aluminum materials, further increasing the burden.

Since April, automobiles have been subject to a 25% tariff, and exports to the U.S. have consistently been on the decline.

Electric vehicles, in particular, are suffering significant impacts.

Last month, only 164 electric vehicles were exported to the U.S., a drastic decrease of 97.4% compared to the same month last year. Even when looking at the period up to July this year, there was an 88.4% drop.

This is believed to be due to the reduction of tax credit benefits for electric vehicle purchases in the U.S., as well as Hyundai and Kia increasing local production to respond to tariffs.

[Joo Won/Director of Economic Research, Hyundai Economic Research Institute: "As the market itself shrinks, the existing demand will likely concentrate on vehicles like Tesla that are not affected by tariffs..."]

Starting next month, as the U.S. electric vehicle tax credit is set to end early, performance may worsen further.

This is KBS News, Choi In-young.

The reason behind our attention to this Korea-U.S. summit is the tariff shock from the United States.

Although tariff negotiations have concluded, the steel industry, which is already facing a high tariff of 50%, and the automobile industry, which is still subject to a 25% tariff, are in a state of emergency regarding exports to the U.S.

Reporter Choi In-young has the details.

[Report]

In March, the U.S. imposed a 25% tariff on imported steel, and in June, it raised the tariff to 50%.

Just one month after the 50% tariff was implemented, our steel exports to the U.S. dropped by nearly 26% compared to the same period last year.

This marks the lowest level in over four years in terms of export value and the lowest in over two years in terms of volume.

[Jang Sang-sik/Director of Trade and Economic Research Institute, Korea International Trade Association: "Considering that there is a one to two-month lag between steel export contracts and shipments, the increase in tariffs and the decrease in imports by the U.S. are directly reflected..."]

Since the 18th, the U.S. has additionally applied a 50% tariff on 407 items, including transformers and home appliances made with steel and aluminum materials, further increasing the burden.

Since April, automobiles have been subject to a 25% tariff, and exports to the U.S. have consistently been on the decline.

Electric vehicles, in particular, are suffering significant impacts.

Last month, only 164 electric vehicles were exported to the U.S., a drastic decrease of 97.4% compared to the same month last year. Even when looking at the period up to July this year, there was an 88.4% drop.

This is believed to be due to the reduction of tax credit benefits for electric vehicle purchases in the U.S., as well as Hyundai and Kia increasing local production to respond to tariffs.

[Joo Won/Director of Economic Research, Hyundai Economic Research Institute: "As the market itself shrinks, the existing demand will likely concentrate on vehicles like Tesla that are not affected by tariffs..."]

Starting next month, as the U.S. electric vehicle tax credit is set to end early, performance may worsen further.

This is KBS News, Choi In-young.

-

-

최인영 기자 inyoung@kbs.co.kr

최인영 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.