BIG DATA IN DISCOVERING TAX DELINQUENCIES

입력 2020.10.06 (15:19)

수정 2020.10.06 (16:47)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

Tax delinquents deliberately hide their assets and evade large amounts of taxes. It is more difficult to uncover their tax evasion if they change their addresses and hide their wealth in cash. But the National Tax Service is doing everything it can do to block them from running away. Big data analysis is the latest technique tax officials are using to discover tax delinquencies.

[Pkg]

[Soundbite] "This is not where I live. (Sir, I am seeing you here right now.) I will go out."

Tax officials comb through the house. Wads of 50,000-won banknotes are found in a bag tucked away inside a closet. The amount totals 100 million won. The tax delinquent was known to have moved to a provincial region. But it turned out that he lives as a tenant in an apartment in Seoul, which is registered in his wife's name. It is actually his house. But he pretends to be a tenant to avoid tax officials' pursuit.

[Soundbite] "(Will you stay here or come in?) I have an appointment."

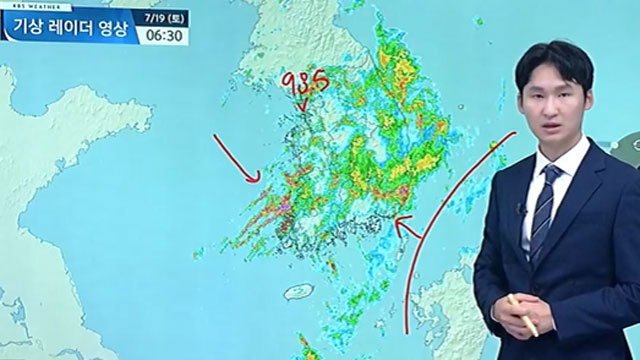

This man was already added to a list of tax delinquents three years ago. Despite his various schemes to evade taxes, he was caught red-handed at his actual residence. Bundles of U.S. dollar bills worth over ten million won were also found, in addition to high-end watches. This feat is thanks to the analysis of big data. The up-to-date technique analyzes extensive information about tax delinquents to locate their whereabouts and identify their hidden assets.

[Soundbite] JEONG CHEOL-WOO(NATIONAL TAX SERVICE) : "We check various points, including if their assets are under their spouses' names or they live in expensive houses."

It uncovers various tax evasion tactics by confirming the offenders' locations and financial transaction records as well as property holdings by their relatives. This is how the tax officials were able to trace and collect evaded taxes of over 1.5 trillion won until August this year. Once a target is selected via big data analysis, tax officials carry out months-long investigations to capture the delinquent on the scene. The National Tax Service has launched intensive crackdowns on 800 high-profile tax defaulters selected through big data analysis.

Tax delinquents deliberately hide their assets and evade large amounts of taxes. It is more difficult to uncover their tax evasion if they change their addresses and hide their wealth in cash. But the National Tax Service is doing everything it can do to block them from running away. Big data analysis is the latest technique tax officials are using to discover tax delinquencies.

[Pkg]

[Soundbite] "This is not where I live. (Sir, I am seeing you here right now.) I will go out."

Tax officials comb through the house. Wads of 50,000-won banknotes are found in a bag tucked away inside a closet. The amount totals 100 million won. The tax delinquent was known to have moved to a provincial region. But it turned out that he lives as a tenant in an apartment in Seoul, which is registered in his wife's name. It is actually his house. But he pretends to be a tenant to avoid tax officials' pursuit.

[Soundbite] "(Will you stay here or come in?) I have an appointment."

This man was already added to a list of tax delinquents three years ago. Despite his various schemes to evade taxes, he was caught red-handed at his actual residence. Bundles of U.S. dollar bills worth over ten million won were also found, in addition to high-end watches. This feat is thanks to the analysis of big data. The up-to-date technique analyzes extensive information about tax delinquents to locate their whereabouts and identify their hidden assets.

[Soundbite] JEONG CHEOL-WOO(NATIONAL TAX SERVICE) : "We check various points, including if their assets are under their spouses' names or they live in expensive houses."

It uncovers various tax evasion tactics by confirming the offenders' locations and financial transaction records as well as property holdings by their relatives. This is how the tax officials were able to trace and collect evaded taxes of over 1.5 trillion won until August this year. Once a target is selected via big data analysis, tax officials carry out months-long investigations to capture the delinquent on the scene. The National Tax Service has launched intensive crackdowns on 800 high-profile tax defaulters selected through big data analysis.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- BIG DATA IN DISCOVERING TAX DELINQUENCIES

-

- 입력 2020-10-06 15:19:31

- 수정2020-10-06 16:47:29

[Anchor Lead]

Tax delinquents deliberately hide their assets and evade large amounts of taxes. It is more difficult to uncover their tax evasion if they change their addresses and hide their wealth in cash. But the National Tax Service is doing everything it can do to block them from running away. Big data analysis is the latest technique tax officials are using to discover tax delinquencies.

[Pkg]

[Soundbite] "This is not where I live. (Sir, I am seeing you here right now.) I will go out."

Tax officials comb through the house. Wads of 50,000-won banknotes are found in a bag tucked away inside a closet. The amount totals 100 million won. The tax delinquent was known to have moved to a provincial region. But it turned out that he lives as a tenant in an apartment in Seoul, which is registered in his wife's name. It is actually his house. But he pretends to be a tenant to avoid tax officials' pursuit.

[Soundbite] "(Will you stay here or come in?) I have an appointment."

This man was already added to a list of tax delinquents three years ago. Despite his various schemes to evade taxes, he was caught red-handed at his actual residence. Bundles of U.S. dollar bills worth over ten million won were also found, in addition to high-end watches. This feat is thanks to the analysis of big data. The up-to-date technique analyzes extensive information about tax delinquents to locate their whereabouts and identify their hidden assets.

[Soundbite] JEONG CHEOL-WOO(NATIONAL TAX SERVICE) : "We check various points, including if their assets are under their spouses' names or they live in expensive houses."

It uncovers various tax evasion tactics by confirming the offenders' locations and financial transaction records as well as property holdings by their relatives. This is how the tax officials were able to trace and collect evaded taxes of over 1.5 trillion won until August this year. Once a target is selected via big data analysis, tax officials carry out months-long investigations to capture the delinquent on the scene. The National Tax Service has launched intensive crackdowns on 800 high-profile tax defaulters selected through big data analysis.

Tax delinquents deliberately hide their assets and evade large amounts of taxes. It is more difficult to uncover their tax evasion if they change their addresses and hide their wealth in cash. But the National Tax Service is doing everything it can do to block them from running away. Big data analysis is the latest technique tax officials are using to discover tax delinquencies.

[Pkg]

[Soundbite] "This is not where I live. (Sir, I am seeing you here right now.) I will go out."

Tax officials comb through the house. Wads of 50,000-won banknotes are found in a bag tucked away inside a closet. The amount totals 100 million won. The tax delinquent was known to have moved to a provincial region. But it turned out that he lives as a tenant in an apartment in Seoul, which is registered in his wife's name. It is actually his house. But he pretends to be a tenant to avoid tax officials' pursuit.

[Soundbite] "(Will you stay here or come in?) I have an appointment."

This man was already added to a list of tax delinquents three years ago. Despite his various schemes to evade taxes, he was caught red-handed at his actual residence. Bundles of U.S. dollar bills worth over ten million won were also found, in addition to high-end watches. This feat is thanks to the analysis of big data. The up-to-date technique analyzes extensive information about tax delinquents to locate their whereabouts and identify their hidden assets.

[Soundbite] JEONG CHEOL-WOO(NATIONAL TAX SERVICE) : "We check various points, including if their assets are under their spouses' names or they live in expensive houses."

It uncovers various tax evasion tactics by confirming the offenders' locations and financial transaction records as well as property holdings by their relatives. This is how the tax officials were able to trace and collect evaded taxes of over 1.5 trillion won until August this year. Once a target is selected via big data analysis, tax officials carry out months-long investigations to capture the delinquent on the scene. The National Tax Service has launched intensive crackdowns on 800 high-profile tax defaulters selected through big data analysis.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.