2022 TAX CODE REVISION

입력 2022.07.22 (15:13)

수정 2022.07.22 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The government has released this year's tax code revision. The plan seeks to lower the corporate tax to revitalize private sector economy and also reduce the tax burden for middle and working class families struggling with high inflation. The most noticeable part of the revision is income tax cuts for salary workers.

[Pkg]

Runaway consumer prices push up living expenses but tax rates remain the same. This is the complaint of office workers who are often dubbed as having "glass wallets" because their wages are easily tracked down.

[Soundbite] Park Chan-jae(Office worker) : "I feel a bit discriminated against when it comes to income tax. Are we easy targets?"

For the first time in 12 years, the government laid out plans to reduce the tax burden for salaried workers.

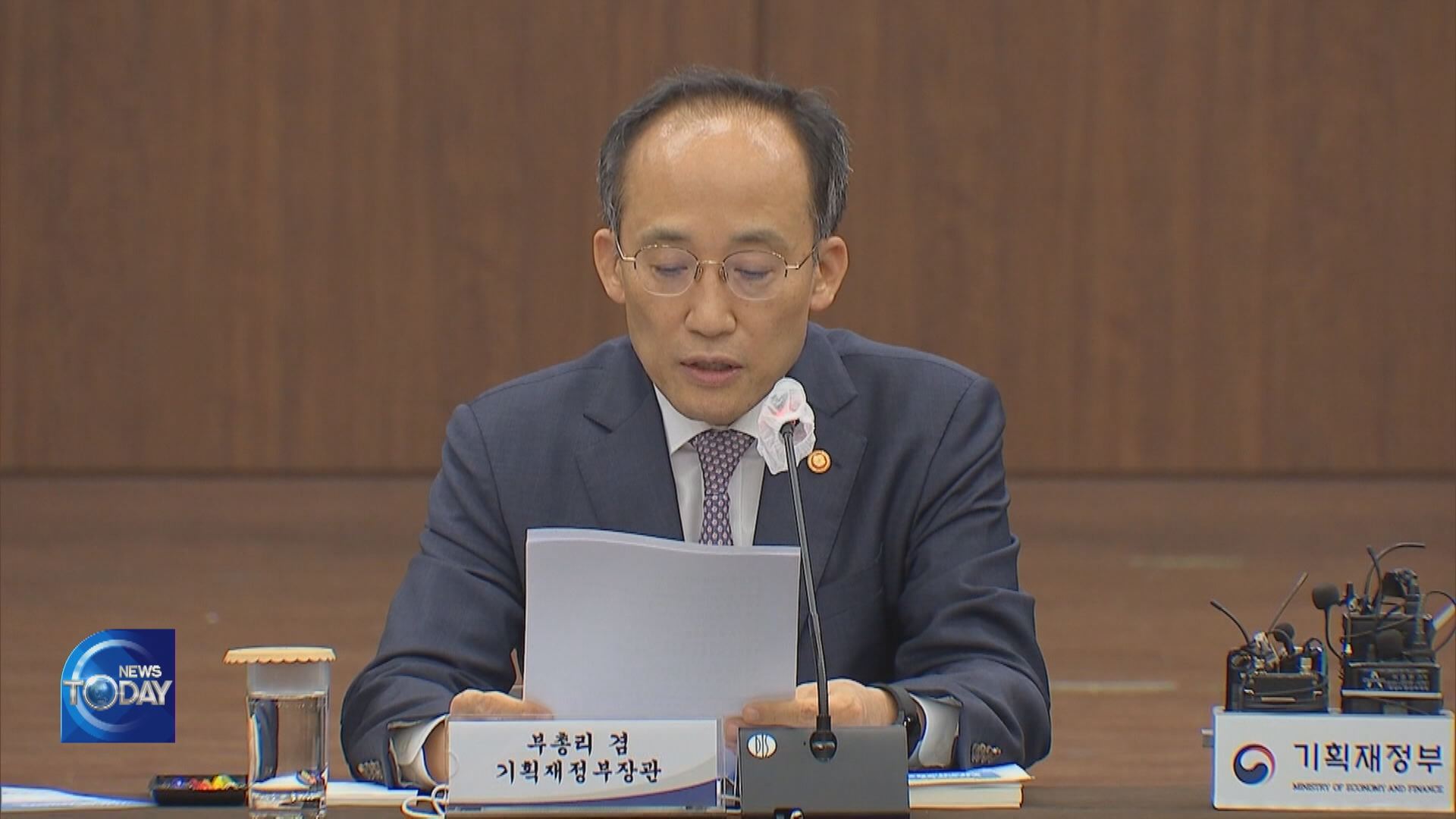

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will seek to reduce the tax burden on middle working classes and provide tax support."

For one, standards for income tax assessment will be adjusted. The lowest tax bracket will see its range rise by two million won and the second lowest bracket by four million won. This will push more people down to a lower tax bracket. Income tax deductions for office workers' meal expenses will also be expanded by an additional 100-thousand won per month. A person with an annual salary of 50 million won, of which taxable earnings are 26.5 million after various exemptions, will see his or her income tax next year drop by around 180-thousand won or some 10.6%. Those earning 78 million won with 50 million in taxable income will pay 540-thousand won less in income tax next year. Considering the expanded meal cost deductions, the income tax burden will drop by as much as 830-thousand won per person. However by reducing the deductible limit, tax cuts will be smaller for the top earning bracket, whose annual wages exceed 120 million won. This measure is likely in view of the criticism leveled at lowering taxes for the wealthy. The government has no plans to introduce a system where tax brackets are adjusted in correlation to consumer inflation.

The government has released this year's tax code revision. The plan seeks to lower the corporate tax to revitalize private sector economy and also reduce the tax burden for middle and working class families struggling with high inflation. The most noticeable part of the revision is income tax cuts for salary workers.

[Pkg]

Runaway consumer prices push up living expenses but tax rates remain the same. This is the complaint of office workers who are often dubbed as having "glass wallets" because their wages are easily tracked down.

[Soundbite] Park Chan-jae(Office worker) : "I feel a bit discriminated against when it comes to income tax. Are we easy targets?"

For the first time in 12 years, the government laid out plans to reduce the tax burden for salaried workers.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will seek to reduce the tax burden on middle working classes and provide tax support."

For one, standards for income tax assessment will be adjusted. The lowest tax bracket will see its range rise by two million won and the second lowest bracket by four million won. This will push more people down to a lower tax bracket. Income tax deductions for office workers' meal expenses will also be expanded by an additional 100-thousand won per month. A person with an annual salary of 50 million won, of which taxable earnings are 26.5 million after various exemptions, will see his or her income tax next year drop by around 180-thousand won or some 10.6%. Those earning 78 million won with 50 million in taxable income will pay 540-thousand won less in income tax next year. Considering the expanded meal cost deductions, the income tax burden will drop by as much as 830-thousand won per person. However by reducing the deductible limit, tax cuts will be smaller for the top earning bracket, whose annual wages exceed 120 million won. This measure is likely in view of the criticism leveled at lowering taxes for the wealthy. The government has no plans to introduce a system where tax brackets are adjusted in correlation to consumer inflation.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- 2022 TAX CODE REVISION

-

- 입력 2022-07-22 15:13:28

- 수정2022-07-22 16:45:29

[Anchor Lead]

The government has released this year's tax code revision. The plan seeks to lower the corporate tax to revitalize private sector economy and also reduce the tax burden for middle and working class families struggling with high inflation. The most noticeable part of the revision is income tax cuts for salary workers.

[Pkg]

Runaway consumer prices push up living expenses but tax rates remain the same. This is the complaint of office workers who are often dubbed as having "glass wallets" because their wages are easily tracked down.

[Soundbite] Park Chan-jae(Office worker) : "I feel a bit discriminated against when it comes to income tax. Are we easy targets?"

For the first time in 12 years, the government laid out plans to reduce the tax burden for salaried workers.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will seek to reduce the tax burden on middle working classes and provide tax support."

For one, standards for income tax assessment will be adjusted. The lowest tax bracket will see its range rise by two million won and the second lowest bracket by four million won. This will push more people down to a lower tax bracket. Income tax deductions for office workers' meal expenses will also be expanded by an additional 100-thousand won per month. A person with an annual salary of 50 million won, of which taxable earnings are 26.5 million after various exemptions, will see his or her income tax next year drop by around 180-thousand won or some 10.6%. Those earning 78 million won with 50 million in taxable income will pay 540-thousand won less in income tax next year. Considering the expanded meal cost deductions, the income tax burden will drop by as much as 830-thousand won per person. However by reducing the deductible limit, tax cuts will be smaller for the top earning bracket, whose annual wages exceed 120 million won. This measure is likely in view of the criticism leveled at lowering taxes for the wealthy. The government has no plans to introduce a system where tax brackets are adjusted in correlation to consumer inflation.

The government has released this year's tax code revision. The plan seeks to lower the corporate tax to revitalize private sector economy and also reduce the tax burden for middle and working class families struggling with high inflation. The most noticeable part of the revision is income tax cuts for salary workers.

[Pkg]

Runaway consumer prices push up living expenses but tax rates remain the same. This is the complaint of office workers who are often dubbed as having "glass wallets" because their wages are easily tracked down.

[Soundbite] Park Chan-jae(Office worker) : "I feel a bit discriminated against when it comes to income tax. Are we easy targets?"

For the first time in 12 years, the government laid out plans to reduce the tax burden for salaried workers.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will seek to reduce the tax burden on middle working classes and provide tax support."

For one, standards for income tax assessment will be adjusted. The lowest tax bracket will see its range rise by two million won and the second lowest bracket by four million won. This will push more people down to a lower tax bracket. Income tax deductions for office workers' meal expenses will also be expanded by an additional 100-thousand won per month. A person with an annual salary of 50 million won, of which taxable earnings are 26.5 million after various exemptions, will see his or her income tax next year drop by around 180-thousand won or some 10.6%. Those earning 78 million won with 50 million in taxable income will pay 540-thousand won less in income tax next year. Considering the expanded meal cost deductions, the income tax burden will drop by as much as 830-thousand won per person. However by reducing the deductible limit, tax cuts will be smaller for the top earning bracket, whose annual wages exceed 120 million won. This measure is likely in view of the criticism leveled at lowering taxes for the wealthy. The government has no plans to introduce a system where tax brackets are adjusted in correlation to consumer inflation.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[HEADLINE]](https://news.kbs.co.kr/data/news/title_image/newsmp4/news_today/2022/07/22/10_5515820.jpeg)

![[단독] 윤석열 정부, ‘대통령실 공사비 미지급’ 피소](/data/news/2025/06/30/20250630_8MRvHk.png)

이 기사에 대한 의견을 남겨주세요.